Contents

On the hunt for unclaimed money or property in Louisiana? The State of Louisiana’s Department of the Treasury operates the Unclaimed Property Division, where you can find information about how to operate an unclaimed property search in Louisiana, as well as a searchable database where you can start your search:

While you may have already known that all U.S. states and territories have easy-to-use websites that can help you find your abandoned property. What you may not realize, though, is that the state websites are only step one in a thorough abandoned property search. To make sure your search has been comprehensive, you can follow our step-by-step guide for finding and claiming your abandoned property.

Many people, especially those who have been contacted by finder or locator services, think that it is difficult to search for and claim your abandoned property. Hopefully, when you finish reading through our guide you will see that, while the process can be time-consuming, it is actually a relatively simple and straightforward one. This is true, not only for abandoned property searches in Louisiana, but also in the other state and federal-level sites that you might need to include in your search.

We get plenty of questions about how to run an unclaimed property search, so one of the things we try to do in this guide is answer the most frequently asked questions we get about the unclaimed money process. The answers to those questions are specifically tailored to a search that starts in Louisiana, though they can also be used to help guide your searches in other databases. We begin with Louisiana’s definition of unclaimed property. We will tell you where to run unclaimed property searches and the links for Louisiana sites and sites outside of Louisiana to run those searches. We provide some background information about unclaimed property databases, including why states have those databases and how the databases work. In addition, we help you understand the unclaimed money process in Louisiana by providing links to Louisiana’s unclaimed money laws. Because we get many questions about how to claim abandoned property, we take you step-by-step through the process for finding and claiming unclaimed money/property in Louisiana. We show you an example of each step, and then give you the information you need to prepare for the type of documentation you may be required to provide to substantiate your claims. We also get many questions about finder/locator services, and we explain what they are, what they do, and whether you need to use them in order to help you find and claim abandoned property.

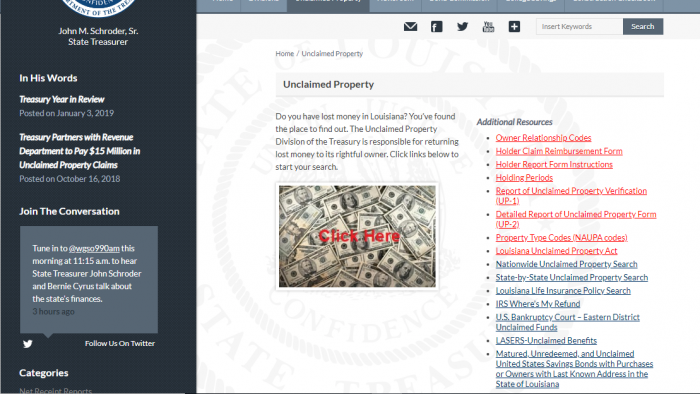

Louisiana’s unclaimed money database provides a link for you to search for unclaimed property in Louisiana. It also includes a number of resources that may be helpful to someone searching for property, including links to information about unclaimed property in Louisiana, links to other states’ databases, and even information about U.S. savings bonds where the owner’s last address was in Louisiana:

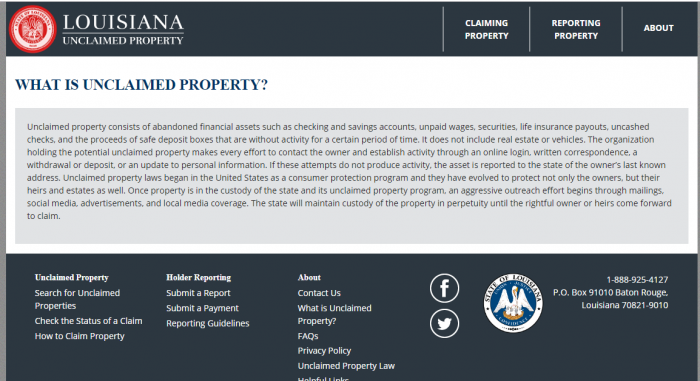

In Louisiana, the state will take possession of property if it is considered abandoned for a statutory period of time. Abandoned property refers to property where the owner has not had contact with the business holding the property and the holder is unable to find the property owner. Each year, businesses known as holders turn over millions of dollars in property, including cash, stocks, bonds, insurance proceeds, and securities, to the State Treasurer’s Office. The state then holds the property as custodian until the real owner can claim the property. People can look for their property in the database or contact the State Treasury at 1-888-925-4127.

If you live in Louisiana or have recently moved from Louisiana, we suggest you begin your unclaimed property search in the state. The most logical starting point for an unclaimed property database is your state’s database. However, do not make the mistake that some people make and assume that searching your state database is enough for a comprehensive property search. It is important to realize that not all money reverts to the custody of the state, even after statutory periods of time. This is particularly true for property that is originally held by federal government agencies like the U.S. Treasury or the IRS. It is also true for property where the location of the owner may not be determined, such as life insurance benefits. In addition, property is going to be linked to the state of the owner’s last known address. This means that you may open an account while living in one state, have a last known address in another state, and then be residing in a third state. As a result, you may need to look in multiple states to find all of your unclaimed property.

Louisiana’s Unclaimed Property Database

Before the development of statewide unclaimed property databases, you had to search at an individual county level to find that unclaimed property. In Louisiana, the local divisions known as counties in other states are known as parishes. Therefore, you can find information about property in all of the following parishes when you look in the state’s unclaimed property database: Acadia, Allen, Ascension, Assumption, Avoyelles, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Caldwell, Cameron, Catahoula, Claiborne, Concordia, De Soto, East Baton Rouge, East Carroll, East Feliciana, Evangeline, Franklin, Grant, Iberia, Iberville, Jackson, Jefferson, Jefferson Davis, La Salle, Lafayette, Lafourche, Lincoln, Livingston, Madison, Morehouse, Natchitoches, Orleans, Ouachita, Plaquemines, Pointe Coupee, Rapides, Red River, Richland, Sabine, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Landry, St. Martin, St. Mary, St. Tammany, Tangipahoa, Tensas, Terrebonne, Union, Vermilion, Vernon, Washington, Webster, West Baton Rouge, West Carroll, West Feliciana, and Winn. You can specifically search by parish, as well as running a search for the entire state.

What is Unclaimed Money?

While the definition of unclaimed property is similar from state-to-state, each state does define it in their statutes. The State of Louisiana defines unclaimed property as various types of abandoned financial assets, not including real estate or vehicles. Examples of unclaimed property include: checking and savings accounts, securities, uncashed checks, unpaid wages, and life insurance payouts. It also includes property in safe deposit boxes, but the contents of the safe deposit boxes may be sold and the state will hold the proceeds for the owner. The property is considered unclaimed if, after a certain period of time, the owner has not made contact with the property holder and the holder has been unable to reach the owner. If the owner establishes contact with the owner through an online login, written correspondence, updating personal information, withdrawals, or deposits.

How Much Unclaimed Money is in Louisiana?

Louisiana currently has over $750 million in unclaimed assets. This is only a portion of the unclaimed money that is available in the United States; the National Association of Unclaimed Property Administrators (NAUPA), estimates that there is at least $42 billion in unclaimed funds available in the United States.

Louisiana Unclaimed Money Finder

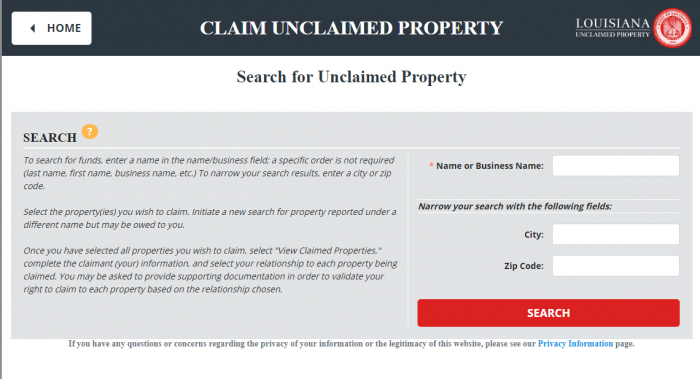

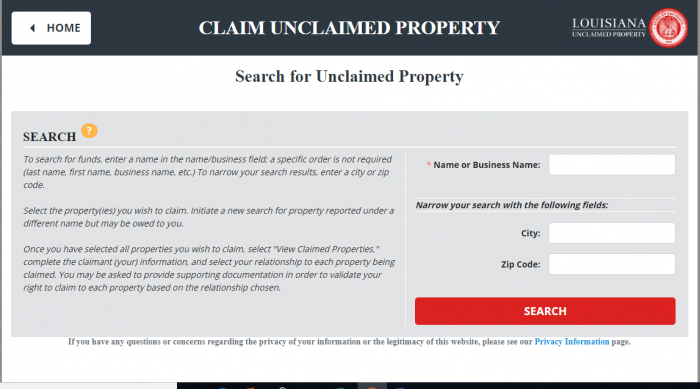

You want to start your search for abandoned assets by beginning at the state’s database.

To begin the search, all you need is a last name or a business name:

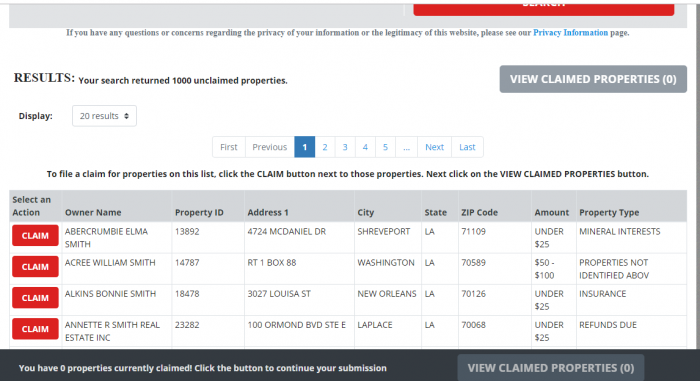

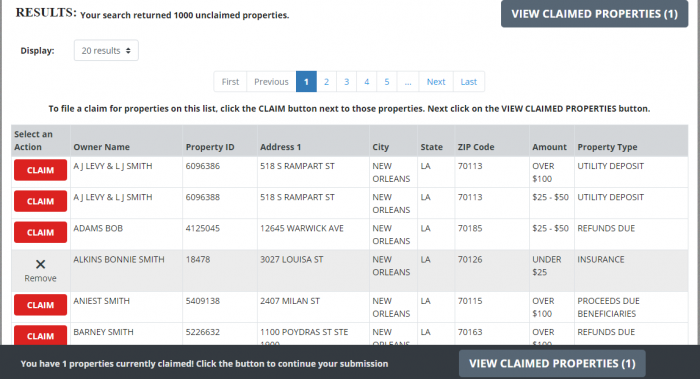

While Louisiana, like most other states, lets you run a search by last-name only, doing so is not necessarily your best option. That is because it may return so many results that your search is practically useless. We start out using the surname “Smith” to show you how a last-name only search might look if you have a common last name. You will see that this search returned 1000 unclaimed properties, but those results are actually inaccurate; the program will only return 1000 results at a time, so there may actually be many more results with the name Smith:

You are not limited to only entering a last name, so you can include other parameters to help limit the search results. Using the full name “Bob Smith” does not really narrow the number of results. However, you will see that the results that have both Bob and Smith in them are included at the top. Just keep in mind that Bob Smith might actually be Robert Smith, might go by Bobby Smith, or be identified as B. Smith. You will want to check for all of those names rather than rely on the top results for the full name search:

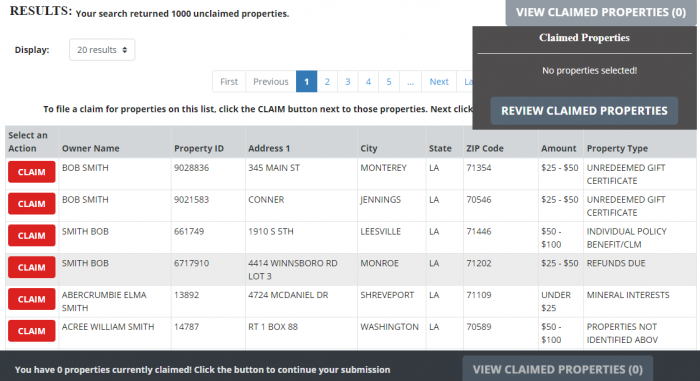

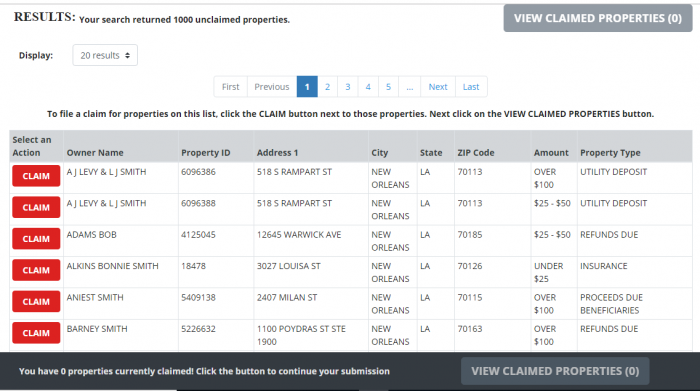

An even better way to narrow down the search results is to include the city or zip code that was in the address at the time. We tried looking for Bob Smith in New Orleans, but did not get any exact matches:

After you have run the search you want and found some possible results, you can begin the claim process. As you can see in the above results, to the left of each record is a red claim button. Once you hit the claim button, it will look like this, and instead of a claim option you will be given a remove option if you do not want to include it in your results:

As you can see, there is a button you can push if you want to view claimed properties. It is located at the top and the bottom of the search page. If you choose to view claimed properties, you will be taken to a property that looks like this:

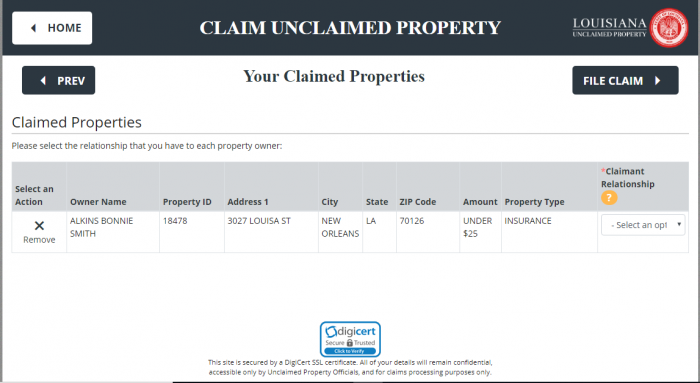

Once you have selected to “view claimed properties” you get a screen that looks like this:

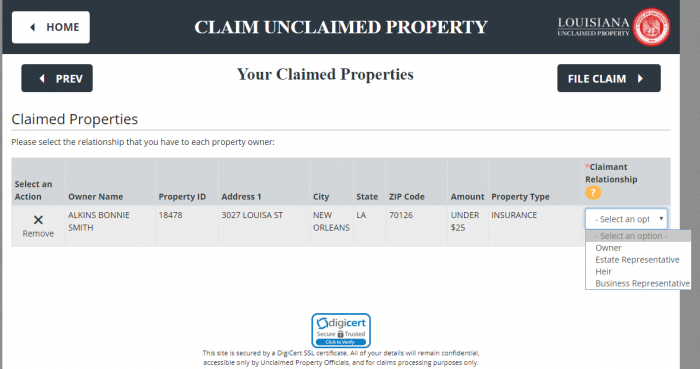

This screen provides an overview of the property. That overview includes the listed owner’s name, the property i.d., the owner’s address at the time the holder last had contact, the city, the state, the zip code, the amount of the claim, and the type of property. You will also notice a box marked claimant relationship, which has a drop down box. You are asked to pick your relationship to the claimant. The options are: owner, estate representative, heir, business representative:

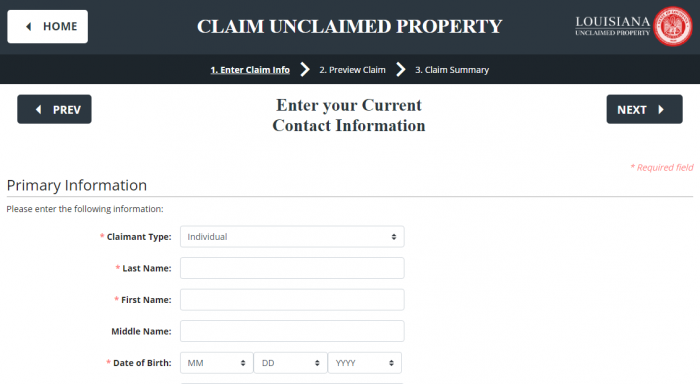

After you make your selection, you are taken to an additional screen. For our example, we selected owner, and hit the File Claim button on the page, to get to this screen:

This contact screen asks you for information that the state needs to help you process your claim. That information includes: claimant type, last name, first name, (middle name is optional), date of birth, email address, home phone, (other phone is optional), social security number or tax ID number, country, address, city, state, zip code, and how you heard about them. Once you fill out the contact sheet, the state lets you know what type of documentation you may need to provide to prove your identity or prove ownership of the property.

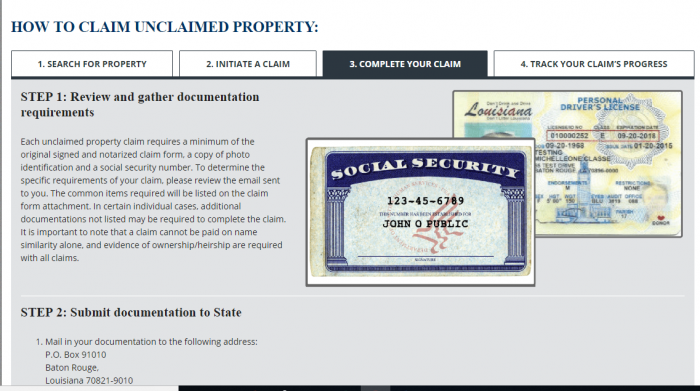

After you have submitted your claim, you need to collect any supporting documents that you were told to gather. For each claim, in addition to the original signed and notarized claim form, you will need a copy of your photo identification and proof of your social security number. You may also need to provide additional documentation:

You send all documentation to the following address:

Division of Unclaimed Property

P.O. Box 91010

Baton Rouge, LA 70821-9010

Unclaimed Money Laws in Louisiana

The Louisiana Uniform Unclaimed Property Act is found in Title 9, Code Book I, Code Title III, Chapter 1 of the Louisiana Revised Statutes.

Louisiana Unclaimed Money FAQ

– How long does Louisiana hold unclaimed money?

Louisiana will hold unclaimed money for the original owner, or their heirs, until the property is claimed.

Examples of Unclaimed Money

Louisiana specifically excludes real property and vehicles, but other property types can become unclaimed money. Some common types of property include: uncashed checks, unclaimed wages, the contents of safety deposit boxes, securities, and money in checking or savings accounts.

Does state of Louisiana make efforts to locate owners?

Louisiana makes several efforts to contact actual owners, including outreach efforts at the last known address. In addition, those without internet access or who need help searching the database can call the Unclaimed Property Division and get assistance running an unclaimed property search.

Other sources to search besides Louisiana state database?

In addition to searching your home state, you will want to include two other components in your search: other states and federal databases.

To determine which states you need to search, you need to look at your life and your family. You want to include any state where you have ever lived. Do you have any out-of-state relatives who many have opened any accounts in your name or who may have left you property? Then, you want to look in those states, as well. In addition, you also want to include any states where you may have business contacts.

While state sources are important, we do not think that any unclaimed property search is complete unless it also contains federal sources. There are four sites we think everyone should check: the National Pension Benefit Guaranty Corporation, the IRS, the U.S. Treasury, and the Life Insurance Policy Locator.

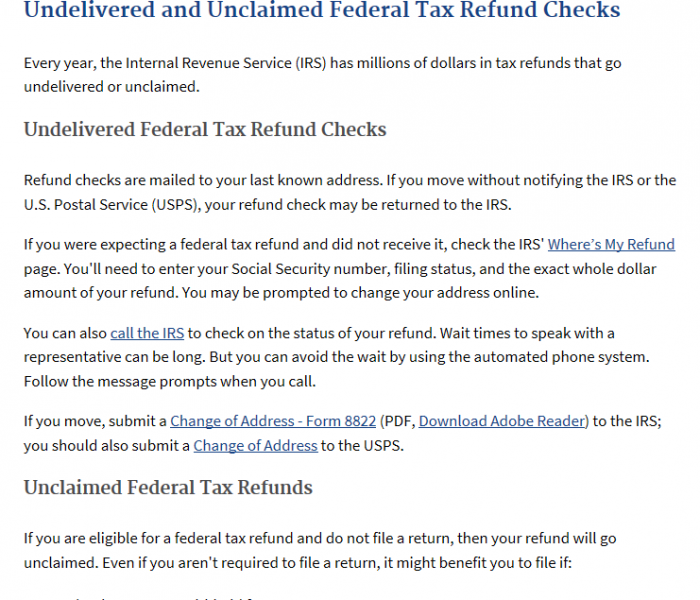

Searching the IRS should be at the top of everyone’s unclaimed property search list, because IRS tax refunds that are returned to sender are not forwarded and never get into a state’s custody:

In fact, if you think you should have received a tax refund, but it is missing, you can look at the IRS’s dedicated Where’s My Refund? page.

While not as critical as the IRS, we also encourage people to check with the U.S. Treasury, because the Treasury has over $17 billion in unclaimed savings bond funds. Unfortunately, they are not as user-friendly as most sites. They no longer have a searchable database. You can visit their website, call them, or write them to search for your unclaimed savings bonds. Their contact number is 844-284-2676 and their website is available at Treasury Direct.

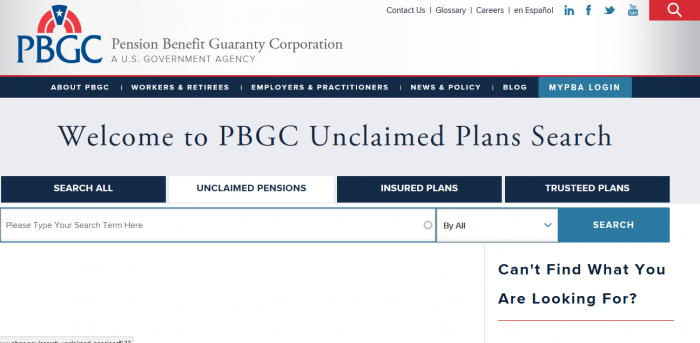

Another important site to search is the Pension Benefit Guaranty Corporation. Many people are unaware that the federal government actually guarantees pension benefits. The PBGC has a searchable database that can help you find any unclaimed benefits. It is an important site to search; a surprising 70,000 potential claimants have over $400 million in unclaimed pension benefits.

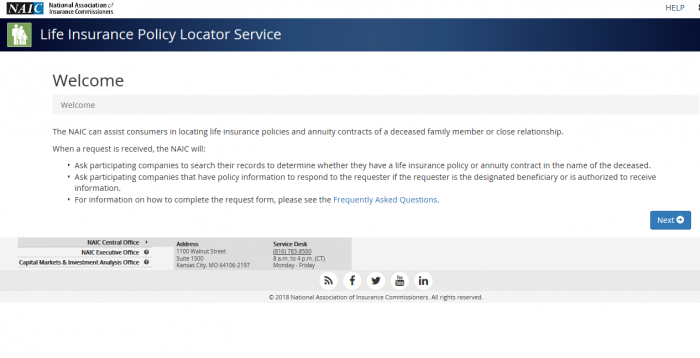

A final source that we call a federal source, though it is actually not a government source, is the National Association of Insurance Commissioners’ Life Insurance Policy Locator Service. This organization is composed of member insurance agencies who have unclaimed life insurance benefits. They do not make their records accessible through a publicly searchable database, but they let you put in your information and their member organizations will search their records to see if you are the beneficiary of any unclaimed benefits. has set up a system that can help you locate unclaimed life insurance benefits:

Although the following sites are not as critical as the four sites we listed above, you may also want to check out:

Department of Housing and Urban Development

National Credit Union Administration

Veteran’s Administration Benefits Department

What is the best way prevent my property from becoming lost or unclaimed?

While finding unclaimed property is great, not losing your property in the first place is even better. That is why we suggest the following steps to keep your property from getting lost:

- Make detailed records of all of your existing accounts and any new accounts. Include the following information: the name(s) on the account, the holder, the holder’s contact information and physical location (if applicable), the account number, and passwords.

- Keep all of your financial information in a central location, except for passwords. Keep them separate from your other financial information.

- If you have tangible property in a safety deposit box, include a key, a box number, and a location address with your account information.

- Make a calendar with reminders to contact your financial institution on a yearly basis and with the dates you are due any deposits, refunds, etc.

- If you have any changes in your personal information, such as name change, address change, change in marital status, contact all of your holders with that information.

- Pick a single email address and select electronic account management when available.

How do I make sure my heirs know where my assets are if I die?

Make sure and designate a trusted individual and tell them where and how to access your account information in the event that you die or are incapacitated. A will is not enough.

Should I hire a finder to conduct the search?

One of the most frequently asked questions that we get, it is also one that we cannot answer for you. Searching for and claiming unclaimed property is free, so there is no financial reason to pay for the service. However, finder services usually charge a percentage of anything they recover, with no cost to you if they do not recover. Because searches can be time consuming, you may find it worth losing a percentage of your unclaimed property to pay a finder to run the claim.

Why does Louisiana take possession of unclaimed property?

The Louisiana unclaimed property process is considered a consumer protection program, and it is designed to help actual owners reclaim their lost property more easily.

Conclusion

Want to be a modern day treasure hunter? Then, begin an unclaimed property search. There are literally billions of dollars out there, just waiting for their real owners to find them. Could you be one of them?