Contents

Connecticut’s Unclaimed Property Division is responsible for safeguarding unclaimed money/ unclaimed property for the people of Connecticut. Once this property is determined to be unclaimed, which depends on a period of abandonment as defined by statute, they are turned over by the holders to the Connecticut Office of the Treasurer. The Office of the Treasurer then holds the property until it can be reunited with the rightful owners of the property or their heirs or assignees. Generally, property is deemed abandoned if the holder of the property has not been able to contact the rightful owner of the property for a statutory period that is usually three to five years.

Some examples of unclaimed property include things such as: uncashed checks, money in checking or savings accounts, matured certificates of deposit, proceeds from life insurance policies, mutual funds, stocks, bonds, money orders, and traveler’s checks. However, this is a non-exhaustive list; other property can be considered unclaimed property. Some property is specifically exempted from being considered unclaimed property.

Once property is turned over to the Connecticut Office of the Treasurer, the Treasurer holds it until the rightful owner is located. Find an overview of Connecticut’s Unclaimed Property program.

If you are new to unclaimed property searches, you may be wondering where to start. For the average person, a thorough property search is going to involve looking at multiple states and at several national-level sites. You could start at any of those sites, but probably the best organized way to start is by searching the state where you reside, because you want to start in the state where you are most likely to find unclaimed property. This guide will outline the other sources you need to search when looking for your abandoned property.

You might think of the unclaimed money search process as confusing or intimidating. Once you finish reading our guide, you will realize that it is actually a fairly simple process. While there are differences between states and the national sites, the search process is similar. The most common complaint is that the process can be very time-consuming, especially if you determine that you have multiple sites to search.

We have gotten a number of questions about running an unclaimed property search in Connecticut. The search process is similar in most states, but, because there are little differences, we have state-specific pages and we run example searches, so you can follow us step-by-step through the process. On this page, we will provide Connecticut’s definition of unclaimed property, provide links to Connecticut’s unclaimed property sites and unclaimed property laws, tell you what type of proof you need to establish your claim, and discuss finder/ locator services.

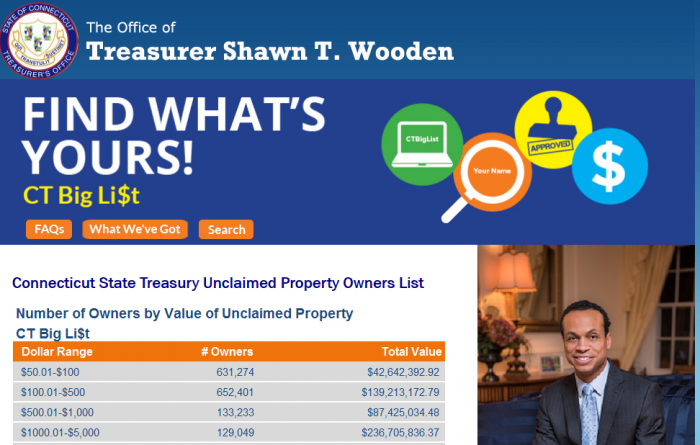

Connecticut’s unclaimed property program is known as CT Big Li$t.

There are several different terms you may hear when people are discussing unclaimed money. Those terms include: unclaimed money, unclaimed property, abandoned money, and abandoned property. Generally, property becomes unclaimed because the owner forgets about the property or dies and the heirs do not know that the property exists.

Connecticut’s Unclaimed Property Database

Before Connecticut developed a statewide unclaimed money database, you would have had to search in individual counties to try to find your lost property. Fortunately, the statewide database covers all of Connecticut’s counties: Fairfield, Hartford, Litchfield, Middlesex, New Haven, New London, Tolland, and Windham.

What is Unclaimed Money?

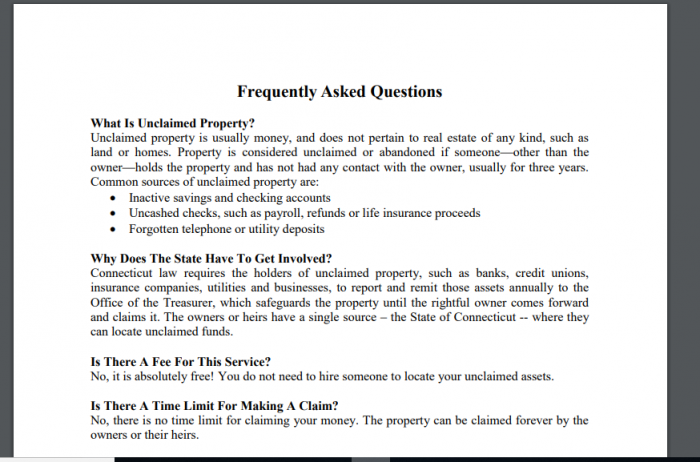

Unclaimed money/ unclaimed property is usually money that has been unclaimed or abandoned. This abandoning happens when the non-owner holder has lost contact with the owner for a statutory period of time, usually three years under Connecticut law. Not all types of property can become unclaimed property; for example, no type of real property can ever become unclaimed property. Common examples of unclaimed property include: uncashed payroll checks, uncashed checks, refunds, life insurance proceeds, savings accounts, checking accounts, and forgotten deposits.

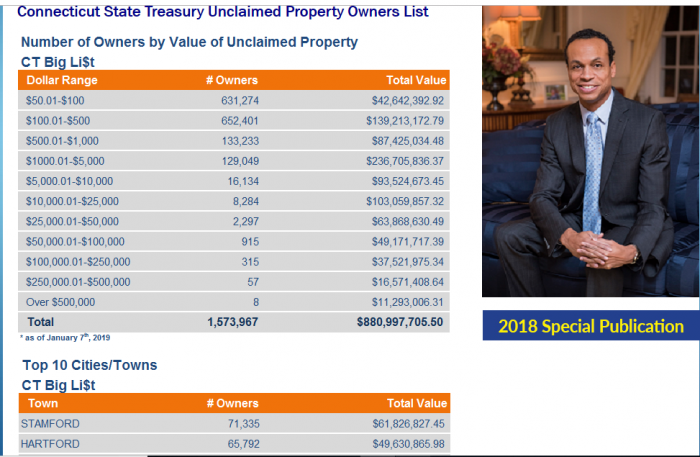

How Much Unclaimed Money is in Connecticut?

Currently, Connecticut has almost $881 million in unclaimed funds. It breaks down the availability of the funds by telling you the amount of funds available in a variety of categories. This is only part of the money available in the United States; the National Association of Unclaimed Property Administrators (NAUPA), an organization devoted to helping people find and reclaim their unclaimed property, says that there is currently at least $42 billion in unclaimed funds available in the United States.

Connecticut Unclaimed Money Finder

You can find Connecticut’s unclaimed money database here

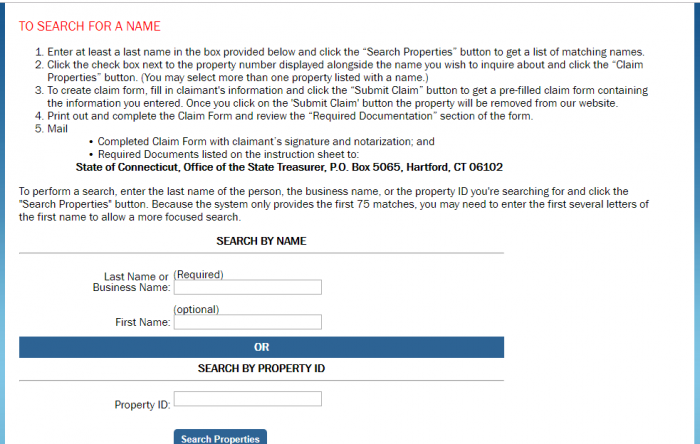

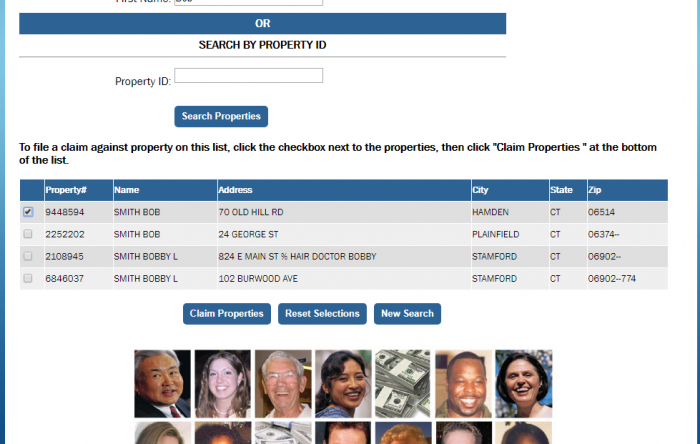

You can start the search with a last name, business name, or property ID number:

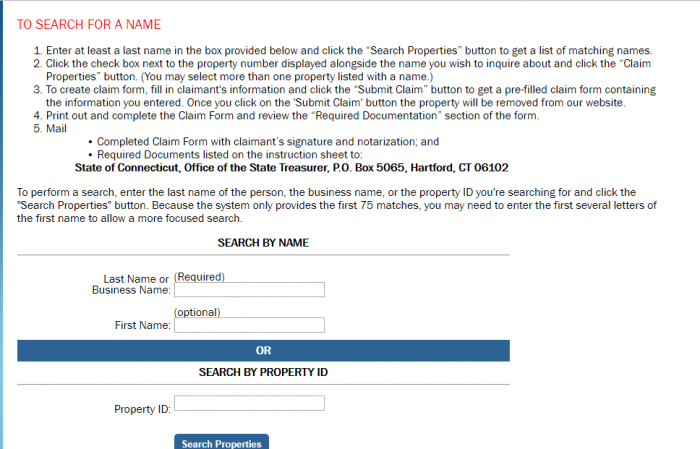

While you can run a search by last name, this may not be a practical option because of the number of results you get. For example, using a common last name, like “Smith” results in a large number of potential results. However, because Connecticut is such a sparsely populated state, this problem is not the same as you will find in other states and even a last-name only search is manageable:

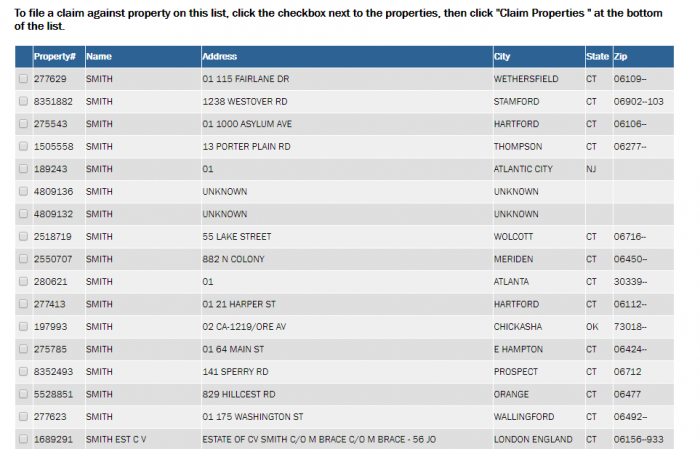

You can narrow down the search. We did this by using a first name, in this case “Bob Smith.” In Connecticut, this took it to four hits:

For each potential property, you get a property number, the name, the address, city, state, and zip code. You do not get an amount for the unclaimed property claim.

In other states, you have the option of listing a city. However, because of Connecticut’s sparse population, you do not really have to search by city. For example, when you search results for a first and last name, you can visually look at them to narrow down the city.

It is important to keep in mind that you may not have opened an account under your legal name. You may actually need to run a search under multiple names including your legal name, nicknames, married names, or maiden names.

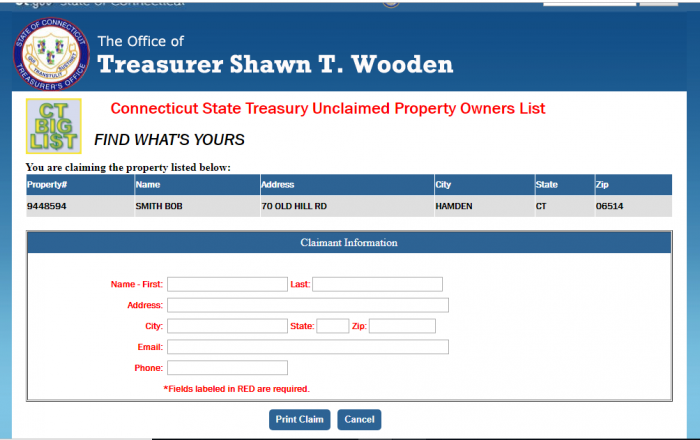

To claim a property, click the box next to the property on the search page:

Once you click on the property to make a claim, you are taken to a page that lets you claim the property and asks you for some basic information. That page looks like this:

The claimant information that you are asked to provide includes your first name, your last name, address, city, state, zip code, email, and phone number.

You can download claim forms at the State Treasury’s website, or you can call 800-833-7318 from 8am to 5pm Monday through Friday to find out if you have any unclaimed property. The only people who can claim property are actual owners or their legal heirs.

Different types of property may require different types of proof. Generally, all claims require the following types of proof, at a minimum: photo identification (government-issued photo ID); proof of your Social Security number or tax ID number; proof of address (the address listed on the property claim); and documents that verify proof of ownership like a tax return or utility bill. In addition, depending on the type of property, you may be asked to provide additional types of proof of ownership or identity:

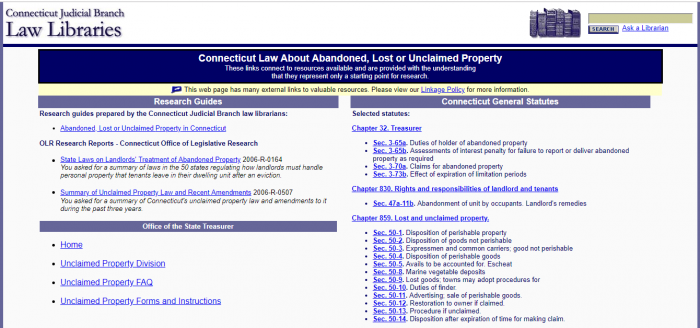

Unclaimed Money Laws in Connecticut

You can find links to Connecticut’s unclaimed property laws at https://www.jud.ct.gov/lawlib/law/abanprop.htm:

The primary unclaimed property law is Connecticut General Statutes Chapter 859, but you can also find information about unclaimed property in Connecticut General Statutes Chapter 32 and Connecticut General Statutes Chapter 830.

Connecticut Unclaimed Money FAQ

How long does Connecticut hold unclaimed money?

There is no time limit for people to make claims for their unclaimed property; the unclaimed property can be claimed by the actual owner or the owner’s heirs forever.

Examples of Unclaimed Money

Some types of property are specifically exempted from becoming unclaimed property, like real estate and motor vehicles. Other than those types of property, almost any kind of property can become unclaimed property, though most unclaimed property will be some form of money. Connecticut specifically lists the following examples of unclaimed money: inactive savings and checking accounts; uncashed checks, such as payroll, refunds, or life insurance proceeds; and forgotten telephone or utility deposits.

Does the state of CT make efforts to locate owners?

The State of Connecticut does not make the same types of outreach efforts that you find in other states, but it does operate a comprehensive database that allows people to search for unclaimed property, as well as a phone number that people can call during traditional business hours to help them locate unclaimed property.

Other sources to search besides CT state database?

The primary place you will want to search is the Connecticut state database. However, there are a number of different other sites that you might want to search to help you find additional sources of unclaimed money.

The first thing you want to do is to make a list of states that you need to search for your unclaimed property or unclaimed money. You want to include the state where you live, any states where you lived in the past, any states where you may have business contacts, and any states where your ancestors lived or may have had any business contacts. To determine whether or not you have business contacts in another state, you want to look at where businesses are headquartered. Once you have made the list of states, you need to check the unclaimed money databases for each of those states.

In addition to checking out state level databases, you need to look at national level databases. Not all of them are going to be applicable for every person, but they are ones that you want to consider when planning your unclaimed property search. We believe that there are four sites that are going to apply to most people running an unclaimed property search: the Internal Revenue Service (IRS), the Pension Benefit Guaranty Corporation, the U.S. Treasury, and the Life Insurance Policy Locator.

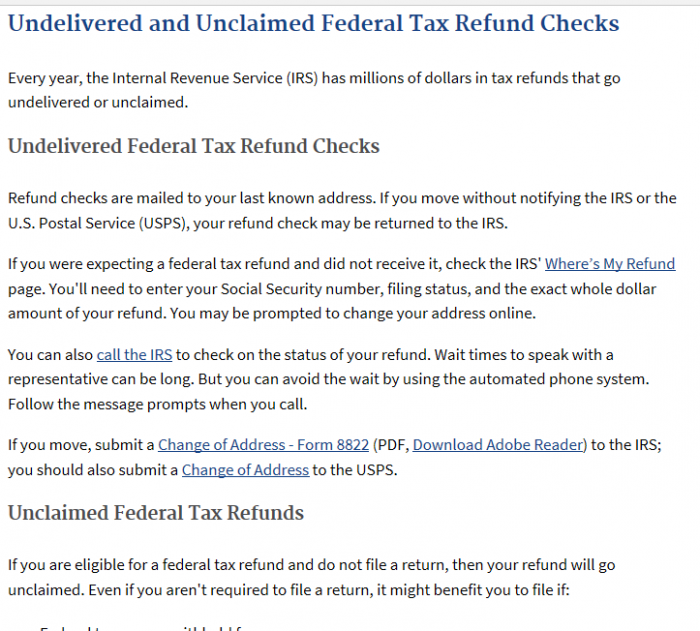

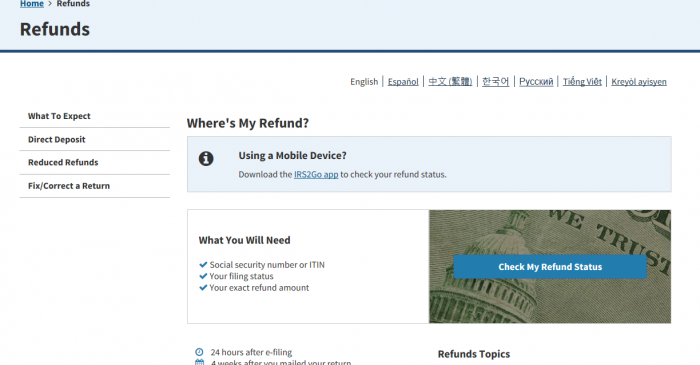

The IRS may be the most important national level site for you to visit when running a search for unclaimed money. It is the single largest issuer of refunds in the United States, because of federal income tax refunds. Even if you have never paid income taxes, you are almost certainly the heir to someone who received or was due to receive income tax refunds. Because the IRS does not forward tax return money when a taxpayer has moved and the money never escheats to the state, the IRS holds that money:

In fact, this is such a common problem, that the IRS has even set up a page specifically designed to help people locate their missing refunds. The IRS has a Where’s My Refund? page on its website:

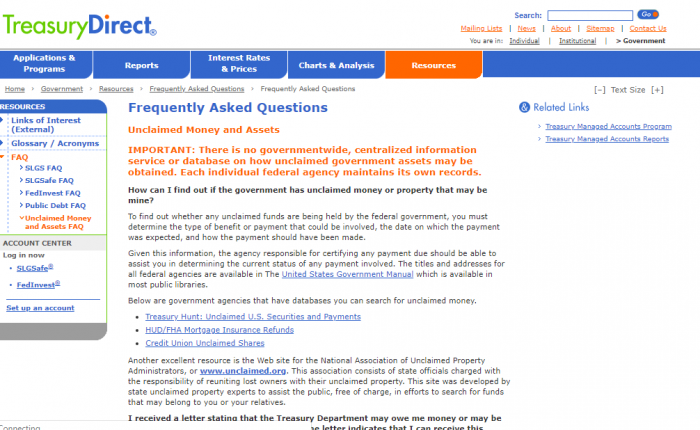

The IRS is not the only federal source for unclaimed property; the U.S. Treasury is another significant source of unclaimed money. Currently, there is over $17 billion in unclaimed property held by the U.S. Treasury because of unpaid savings bond funds. The U.S. Treasury used to have a database that was similar to the unclaimed property databases held by the states. They removed that website, and have made it somewhat more difficult to file an unclaimed property claim. To find out more about that process, you can call them at 844-284-2676 or visit the U.S. Treasury website at Treasury Direct:

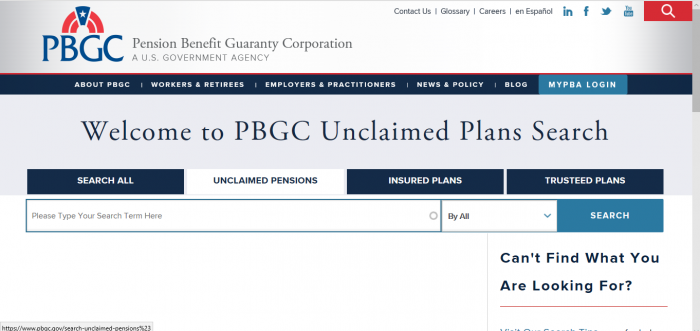

Because many companies no longer offer pensions, people often overlook pensions when they are searching for unclaimed money. However, for many middle-age workers, their first jobs may have had pensions. In addition, if you are searching as an heir to an older person, there is a high likelihood that they had some type of pension benefits. Moreover, pension benefits are actually guaranteed through a division of the federal government, the Pension Benefit Guaranty Corporation (PBGC). One of the roles that the PBGC plays is that it helps people find missing property. It operates an extremely user-friendly database. According to the PBGC, there are over 70,000 people with missing pension benefits, with a total of $400 million in potential benefits available. One of these claims is worth over $1 million. You can search for unclaimed pensions on the PBGC page:

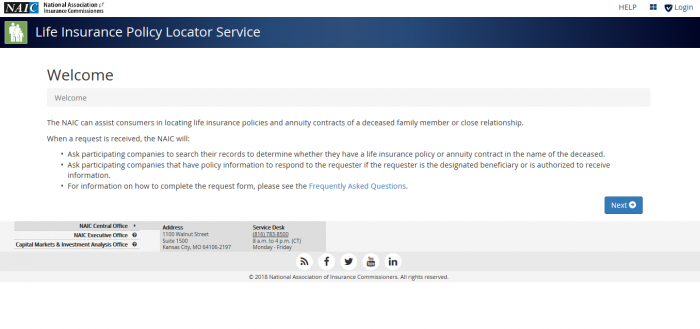

Another very important site to search, especially if you have a loved one that has left you an heir or would have named you as a beneficiary on a life insurance policy. Then, you need to go visit the website at the National Association of Insurance Commissioners’ Life Insurance Policy Locator Service. While it does not operate a user-friendly database that operates the same way as the state websites or some of the national-level websites, it does help connect you with lost property. The website is run by an insurance industry organization and allows you to submit information to it so that the member insurers can search their databases and see if you have any unpaid claims:

There are some other sites that you may want to check out when you are running an unclaimed property search. Not all of them will be applicable to every person running a search, but if your financial past suggests that they might be applicable for you, then you want to include them in your search. These four sites are: the FDIC site, the Department of Housing and Urban Development site, the National Credit Union Administration site, and the Veteran’s Administration Benefits Department.

What is the best way prevent my property from becoming lost or unclaimed?

While finding unclaimed property is great, it is even better to not lose track of your property in the first place. That is why we are providing a list of tips that you can use to help you keep track of unclaimed property.

The most important step is to document all of your financial accounts. Document the ones that you currently have, then use the same system to document any new accounts. We suggest using electronic banking when it is available and setting up an email that is dedicated to your financial dealings. When you open an account, you want to make sure and include the following information in your account information: the name you used on the account; the date you opened the account; the account number, due dates for any deposits or rebates; and the contact information for the holder, including a physical location when applicable.

You also want to keep track of your passwords and have them where a trusted person can access them, if necessary. However, in the interest of safety, you do not want to store passwords in the same location as your other account information.

If you get a check, promptly deposit it.

Set up an annual date to review your accounts and contact any financial institutions that you have not contacted in the past year.

Let all of your financial institutions know if you have a change in address, phone number, marital status, or name.

If a financial institution or other holder contacts you, respond to the contact.

How do I make sure my heirs know where my assets are if I die?

Do not make the very common mistake of assuming that having a will means your heirs will know where your assets are located if you die. A will only tells people what to do with your assets; it does not tell them where to find those assets. You need to designate a trusted person and tell them how to access your financial information and passwords in the event that you die or are incapacitated.

Should I hire a finder to conduct the search?

This may be the number one question that we get. The answer really depends on you. First, you need to understand what a finder is. A finder, which may also be known as a locator, is a third-party that searches for and claims unclaimed property. They charge a fee for this service, and the fee is usually a percentage of any property that they recover on your behalf. Many people think that finder services are unnecessary because it is free to run unclaimed property searches, not just in Connecticut, but in other state and national level databases. However, because the process can be time consuming, you have to consider whether or not you would actually run the search on your own. If your answer is “no,” then hiring a locator service might make sense for you.

Why does Connecticut take possession of unclaimed property?

Because most unclaimed property is unclaimed because it has been forgotten, leaving it in the hands of private holders greatly reduces the odds that the actual owners will be reunited with their money. By placing it in a single state database, Connecticut increases the chances that people will be reunited with their unclaimed property.

Conclusion

For a state with such a small population, Connecticut has a disproportionate share of the $42 billion in unclaimed assets available in the United States. For that reason alone, we would suggest that people include Connecticut when running an unclaimed property search.