Contents

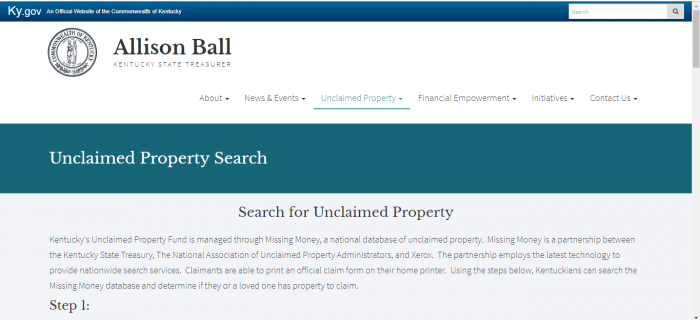

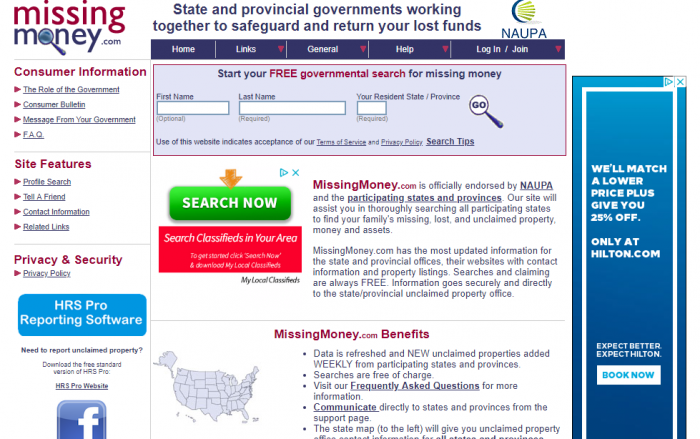

Are you trying to find unclaimed property in Kentucky? Kentucky’s State Treasurer uses the Missing Money website to help people run unclaimed property searches if they believe they have unclaimed or abandoned property in the state:

You may have already been aware that Kentucky has a website that you can use to help you locate your abandoned property. However, you may not realize that a thorough search for unclaimed property does not stop with a search of your state’s unclaimed property website. Instead, that should only be the first step in a search for abandoned property. This comprehensive guide will not only tell you how to use Kentucky’s unclaimed property search, but also lead you through the other steps in a search for unclaimed property.

If you have been contacted by a locator or a finder service, offering to help you search for and claim your unclaimed money, you may believe that searching for and claiming money is a difficult process. While the process can be time consuming and may take a number of steps, the process is actually relatively straightforward. In fact, you take similar steps to operate a search in almost every state and use a similar approach at many federal sites.

The goal of this guide is to answer the most frequently asked questions we get about searching for unclaimed money in Kentucky. We have an information site for each state, because there are subtle differences for each state, but you can apply these same principles to searches in any state. This guide provides Kentucky’s definition of unclaimed property. It also provides the links for Kentucky’s unclaimed property site and other popular unclaimed property databases. The site has additional links to Kentucky’s unclaimed property laws. We do an example search for property at Kentucky’s unclaimed property site and take you through that process step-by-step. In addition, we provide you with what you need to know in order to get the documentation you are required to provide to prove your claim. Finally, we discuss finder/locator services and whether you need them to find and claim your unclaimed property.

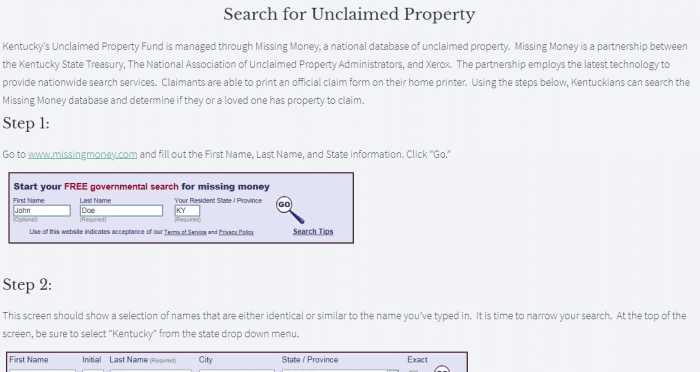

Kentucky’s unclaimed money database is operated by Missing Money. There, you find links that help you search for unclaimed money or property in Kentucky. You will be directed to fill in information such as the claimant’s name and state information:

The Kentucky State Treasurer is responsible for administering Kentucky’s Unclaimed Property Fund. Unclaimed property or money may also be referred to as abandoned property or money. This is money that belongs to one party, generally referred to as the property owner, but is being held by a third party, usually a bank, business, or financial institution, in the course of business. The property is considered unclaimed or abandoned if there is no activity on the account and the holder is unable to contact the property owner. Some examples of unclaimed property include payroll checks, old life insurance policies, vendor checks, stocks, and the contents of safety deposit boxes. People may be able to claim their own unclaimed property or make claims for property for relatives under some circumstances.

The Kentucky database is a good place to begin your unclaimed property search if you live in Kentucky or if you recently lived in Kentucky. That is because starting at your state’s database is the logical beginning for an unclaimed property search. This is doubly true for a state like Kentucky that uses Missing Money to run its missing property databases, because you are able to search multiple databases at one site. Just be aware that not all states use Missing Money, so you may have to go to other state websites.

In addition, many people do not realize that not all types of money will revert to state custody. For example, if the federal government is the original holder for the money, then the money will remain in the custody of the federal government. Things like IRS returns or U.S. Savings Bonds stay with the federal government. In addition, the federal government guarantees pension benefits and they may be held by the company and not reported to state unclaimed money databases, depending on circumstances. There are other types of unclaimed money that might not show up in state databases because the holder does not have an address for the actual owner and, therefore, does not know where to report the money; one example of this is life insurance benefits.

Kentucky’s Unclaimed Property Database

While knowing specific location information can help you locate unclaimed money more easily, Kentucky has consolidated all of its unclaimed property information into a single database. This makes it easy for you to find property without searching in multiple locations. At that state database you can find information for all of Kentucky’s 120 counties: Adair, Allen, Anderson, Ballard, Barren, Bath, Bell, Boone, Bourbon, Boyd, Boyle, Bracken, Breathitt, Breckinridge, Bullitt, Butler, Caldwell, Calloway, Campbell, Carlisle, Carroll, Carter, Casey, Christian, Clark, Clay, Clinton, Crittenden, Cumberland, Daviess, Edmonson, Elliott, Estill, Fayette, Fleming, Floyd, Franklin, Fulton, Gallatin, Garrard, Grant, Graves, Grayson, Green, Greenup, Hancock, Hardin, Harlan, Harrison, Hart, Henderson, Henry, Hickman, Hopkins, Jackson, Jefferson, Jessamine, Johnson, Kenton, Knott, Knox, Larue, Laurel, Lawrence, Lee, Leslie, Letcher, Lewis, Lincoln, Livingston, Logan, Lyon, McCracken, McCreary, McLean, Madison, Magoffin, Marion, Marshall, Martin, Mason, Meade, Menifee, Mercer, Metcalfe, Monroe, Montgomery, Morgan, Muhlenberg, Nelson, Nicholas, Ohio, Oldham, Owen, Owsley, Pendleton, Perry, Pike, Powell, Pulaski, Robertson, Rockcastle, Rowan, Russell, Scott, Shelby, Simpson, Spencer, Taylor, Todd, Trigg, Trimble, Union, Warren, Washington, Wayne, Webster, Whitley, Wolfe, and Woodford.

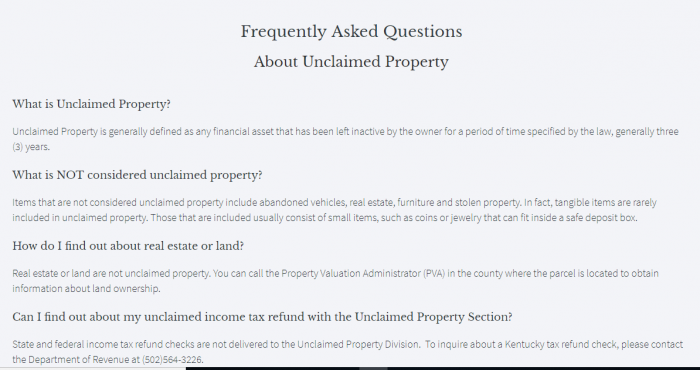

What is Unclaimed Money?

In Kentucky, unclaimed property is defined as a financial asset that has been left inactive by the owner for a period of time as defined by statute. Generally, that statutory period is three years. However, not all types of property become unclaimed property. Things that are specifically exempted from the unclaimed property laws include most tangible items, including: motor vehicles, real estate, and furniture. Usually, the only tangible items that can become abandoned property are those that can fit inside a safe deposit box. In addition, stolen property cannot become abandoned property. One interesting thing about Kentucky is that its state income tax refund checks do not ever become unclaimed property in the custody of the state’s unclaimed property fund.

How Much Unclaimed Money is in Kentucky?

There is almost $500 million in unclaimed assets in Kentucky’s Unclaimed Property Fund. That is only a portion of the unclaimed money that may be available to current and past Kentucky residents; according to the National Association of Unclaimed Property Administrators (NAUPA), a professional organization devoted to helping property owners find and claim their lost assets, there is currently at least $42 billion in unclaimed funds available in the United States.

Kentucky Unclaimed Money Finder

Kentucky uses the Missing Money database to help you locate your unclaimed/abandoned money and property in the state. Go to http://www.missingmoney.com/:

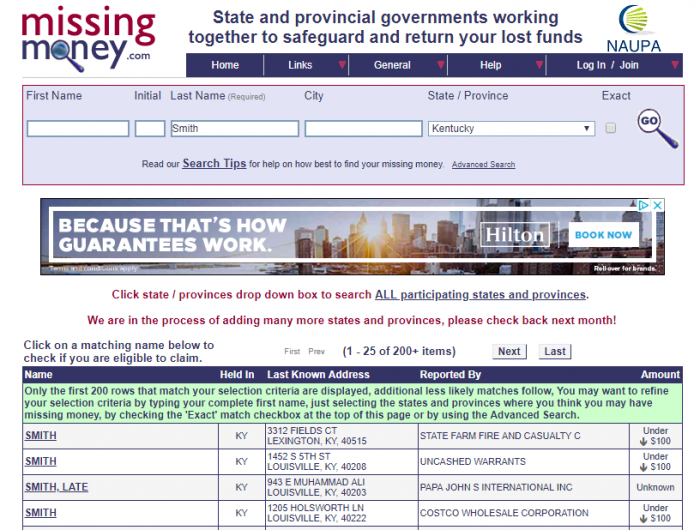

Starting your search is easy, you just need a last name:

Although Kentucky provides you with the option to search by last name, unless that name is very unique, a last-name only search is probably not the best option. To highlight why there might be problems with running a last-name only search, we ran a search for Kentucky using only the last name Smith. It came back with more than 200 results, with a 200 result maximum per search:

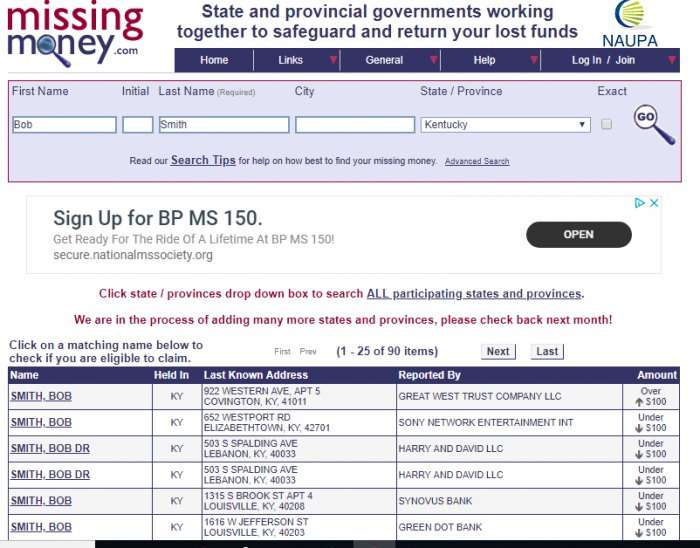

Fortunately, we are not limited to last-name only searches. You can include a first name to narrow down your results. We chose another common name “Bob” and ran a search for the full name “Bob Smith.” Because Kentucky is a relatively small state, this actually resulted in a meaningful narrowing of results, and we were left with only 90 possible hits:

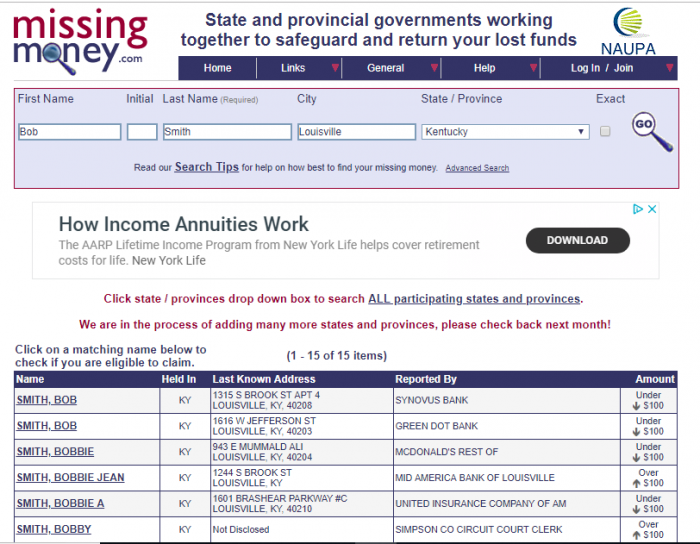

However, you can tailor your search in an even more specific manner by including a city in your search parameters. When we only looked for Bob Smith with a last known address in Louisville, the search results went down to 15 possible results:

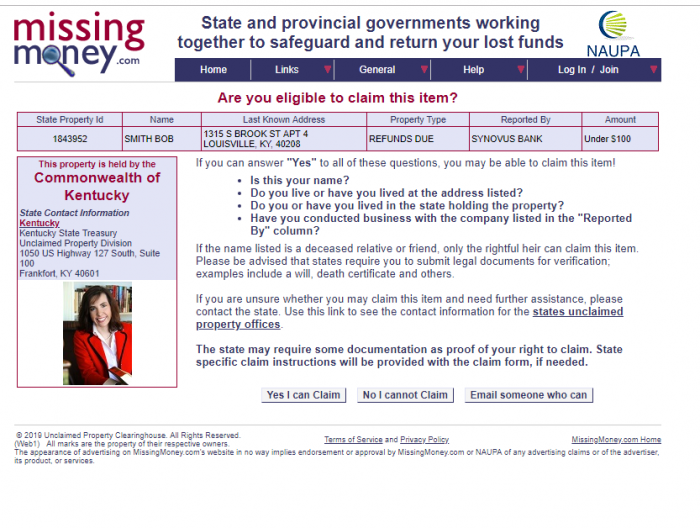

Once you have located property that might be yours, you can begin the claim process. On Missing Money, you click on the name part of the record to get further information and see if you are eligible to claim the property. Only if you can answer yes to the listed questions can you claim the property. The questions are:

Is this your name?

Do you live or have you lived at the address listed?

Do you have or have you lived in the state holding the property?

Have you conducted business with the company listed in the “Reported By” column?

There is an exception to the name requirement, because rightful heirs to property owners can also claim property, but will be required to submit legal documentation, including a death certificate, for verification:

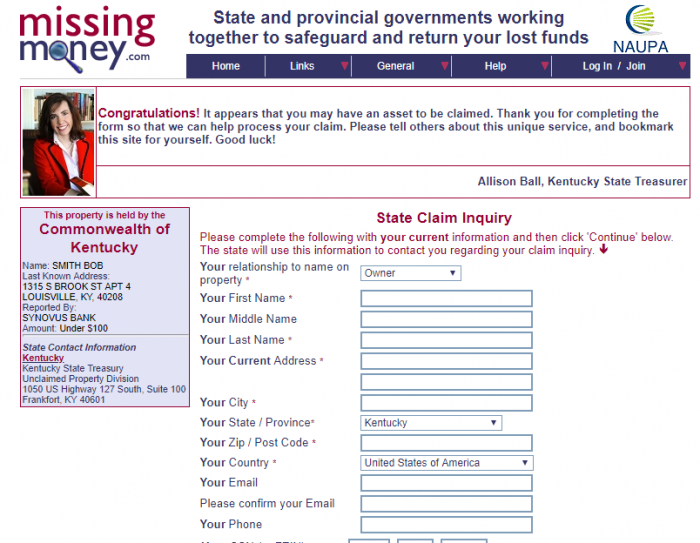

Once you have selected the “yes I can claim” button, you are taken to a State Claim Inquiry form. This form asks for you to provide important information for your claim, including: first name, last name, middle name, current address, current city, current state, current zip code, current country, your email address, your phone number, your social security number or tax identification number, and your date of birth:

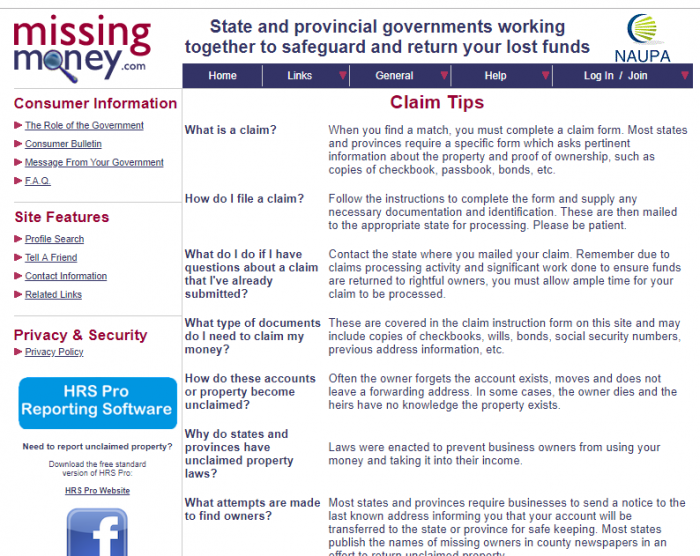

Each different type of claim may have slightly different instructions and different instructions for how to submit the claim and any necessary documentation. Follow the specific instructions for your claim exactly or else there may be a delay in getting your funds. In addition, make sure and provide all requested documentation. Examples of the types of identification that might be requested include: photo identification, proof of address, proof of social security number, and legal documents if you are claiming on behalf of another party:

The state contact information for unclaimed money in Kentucky is:

Kentucky State Treasury

Unclaimed Property Division

1050 US Highway 127 South, Suite 100

Frankfort, KY 40601

Unclaimed Money Laws in Kentucky

The Kentucky Treasurer puts out a comprehensive handbook covering the holder’s responsibilities regarding unclaimed money. This handbook answers many of the technical questions that people may have about unclaimed money in Kentucky. In 2018, Kentucky passed a version of the 2016 Uniform Unclaimed Property Act. This law made some substantive changes to unclaimed money laws in Kentucky, most notably to statutory periods before certain types of property would be considered abandoned.

Kentucky Unclaimed Money FAQ

How long does Kentucky hold unclaimed money?

Kentucky has no time limit for filing a claim; the money will be held indefinitely for the named owner or for that owner’s lawful heirs.

Examples of Unclaimed Money

Unclaimed property is generally money-based property, such as uncashed checks, money in savings accounts, money in checking accounts, unpaid deposits, and other negotiable interests. Generally, tangible property is not going to be considered unclaimed property, though property that fits into a safe deposit box can be unclaimed property. Automobiles and real property are not unclaimed property.

Does the state of KY make efforts to locate owners?

Yes. The state operates and maintains the unclaimed property database on Missing Money, sets up a booth at the Kentucky State Fair to inform the public about unclaimed money, and routinely informs the public about the Unclaimed Property Division. However, Kentucky does not make efforts to reach individual owners.

Other sources to search besides KY state database?

If you only search for your money on Kentucky’s database, you may be missing out on opportunities to find other money that might belong to you. In addition to searching in your home state, you want to search any state where you might have financial assets, as well as some important national-level databases.

We suggest making a list of all of the state databases you should search. You want to include any states where you have resided in the past or where you may have had business relationships. You also want to be sure and include any states where out-of-state relatives may have put money in your name, including states where relatives who have deceased resided, if that relative left you as an heir to his or her property.

In addition, there are some very important national-level databases everyone should search when trying to find abandoned property. The top four are: the Internal Revenue Service, the Pension Benefit Guaranty Corporation, the U.S. Treasury, and the Life Insurance Policy Locator.

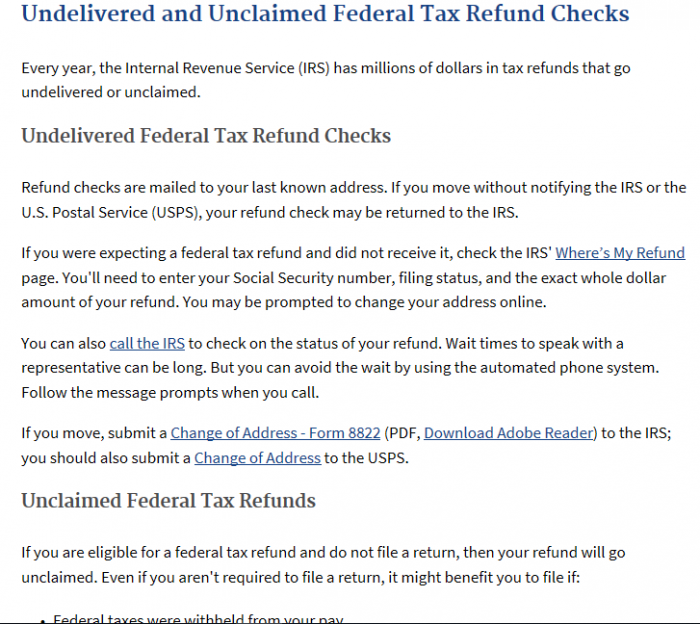

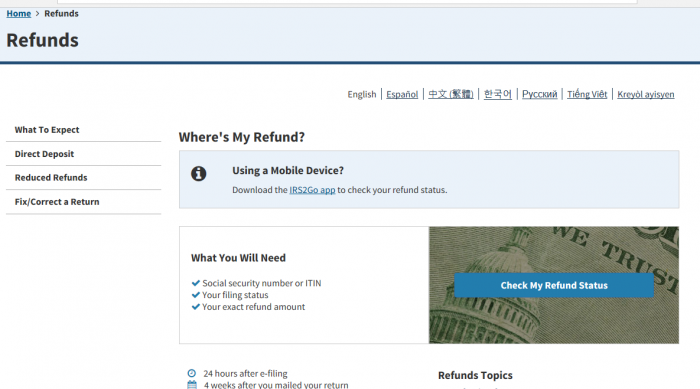

You may not realize this, but everyone should check the IRS for unclaimed property because the IRS does not forward income tax return refunds if a person moves and those funds never become part of a state’s unclaimed property:

If you are looking for a more recent IRS refund, you can even skip the unclaimed property claim process and head over to the Where’s My Refund? page on the IRS website:

Another important federal source for unclaimed funds is the U.S. Treasury. U.S. Savings bonds do not generally become part of a state’s unclaimed property, though they may show up on some state claims if the bonds have been stored in a safe deposit box. This is an important place to look, because the U.S. Treasury is holding over $17 billion in unclaimed property due to unpaid savings bond funds. While the Treasury no longer maintains an easily searchable database, you can claim your lost bonds by visiting their website, calling them, or writing to them. The U.S. Treasury’s phone number is 844-284-2676 and their website is available at Treasury Direct.

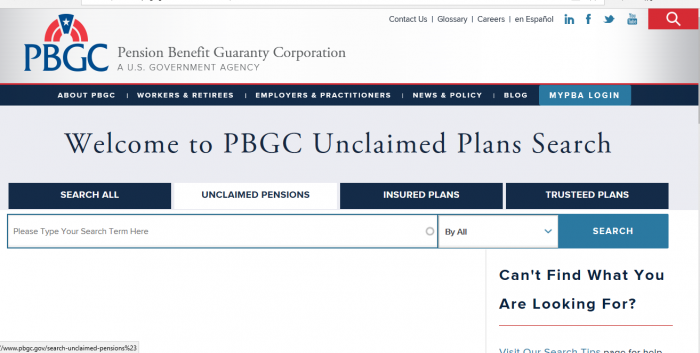

Because most companies have moved away from pensions many people may not realize that they have pension benefits available to them. However, we strongly suggest that you include the Pension Benefit Guaranty Corporation in your search. The PBGC is a federal government organization that guarantees pension benefits, and it offers a searchable database that can help people determine whether they have any unclaimed pension benefits. It happens more often than you might thing: over 70,000 potential claimants have failed to claim their benefits, with a total of $400 million in benefits waiting to be claimed. While most unclaimed money amounts are relatively small, there is one potential claimant with a pension amount worth more than $1 million:

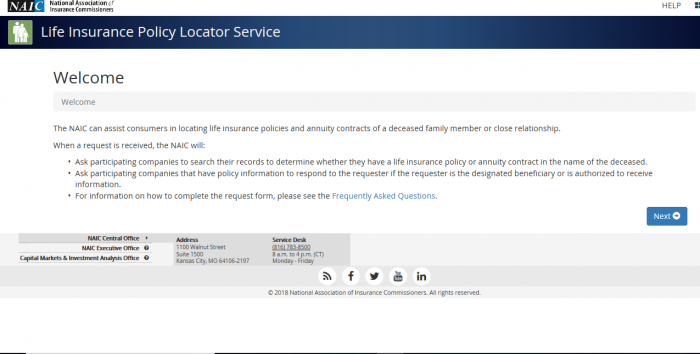

Another national-level site to check is the National Association of Insurance Commissioners’ Life Insurance Policy Locator Service. Not a government source, this private organization is part of the insurance industry and is a way for its member insurance agencies to try to locate beneficiaries of life insurance policies. It is not very user-friendly; you cannot search the database, but it lets you put in your information so that member insurers can check their records to see if they owe you any money:

In addition to our top four, there are some other sites that may be holding onto your money: the Federal Deposit Insurance Corporation (FDIC), the Department of Housing and Urban Development (HUD), the National Credit Union Administration, and the Veteran’s Administration Benefits Department,

Department of Housing and Urban Development

National Credit Union Administration

Veteran’s Administration Benefits Department

What is the best way prevent my property from becoming lost or unclaimed?

The Commonwealth of Kentucky has actually compiled a list of steps you can take to help keep your property from becoming unclaimed. They suggest that you:

Cash all checks promptly;

Keep thorough and accurate records of all of your financial accounts;

Review your account records at least once a year;

Maintain yearly activity on all financial accounts;

Provide financial institutions with primary and secondary contact information;

If you have a beneficiary on an account, provide the institution with beneficiary contact information;

Respond to all notifications from a business or financial institution;

Keep a list of all of your financial accounts, including bank accounts, broker accounts, utility and other deposits, safe deposit boxes, and stock certificates;

Notify all account holders with your new address if you move; and

If you stop receiving dividend checks, immediately contact the financial institution.

How do I make sure my heirs know where my assets are if I die?

Do not make the common mistake of assuming that a will is sufficient to make sure that your heirs get the property you intend to leave them. Designate a responsible person who can get access to your financial account information in the event of your death or incapacitation

Should I hire a finder to conduct the search?

Kentucky recommends that you attempt a search yourself before hiring a finder service or signing a contract to hire a finder service. That is because the search and claim process are free and you do not need a finder to do that for you. On the other hand, if you do not have the time to conduct your own search, a finder service can help you locate your missing assets.

Why does Kentucky take possession of unclaimed property?

Unclaimed property laws are consumer protection statutes that are designed to simplify the process of connecting a property owner with the holder of that property.

Conclusion

Billions of lost assets are waiting to be claimed. Are some of them yours? The only way to find out if you have any unclaimed property in Kentucky is to start your unclaimed money search.