Contents

Looking for unclaimed property in Massachusetts? Then you want to make sure and visit the website for Massachusett’s Unclaimed Property Division, where you can find more information about the unclaimed property process in Massachusetts, then head over to www.findmassmoney.com to search for your unclaimed property and claim it.

While Massachusetts’s database can help you find your unclaimed property, the reality is that most people have business contacts outside of the state, not just in it. That is why searching your state’s unclaimed property database is only one part of a complete unclaimed property search. For a thorough search, you want to make sure you follow all of the steps in our handy how-to guide.

In this comprehensive guide to finding and claiming unclaimed property, we provide all of the information you need to start your own property search. We start by answering some of the most frequently asked questions that we get. Read on to find out the answers to the following questions: What is unclaimed money/ abandoned property? How do you search for unclaimed money? Where can I search for unclaimed property? What are the links to the Massachusetts resources I should search for unclaimed property? Why do states have unclaimed money or property databases? What is Massachusetts’ unclaimed property law? What other places can I search for property? How do I claim property once I have found it? What type of documentation will I need to file an unclaimed property claim? What is a finder service? Should I use a finder service?

In Massachusetts, the Commonwealth Treasurer oversees the unclaimed property program. The program requires holders, which are third-party institutions, business, or organizations that have been entrusted to hold your money or other property, to report on any funds that have been abandoned for a period of three years and then turn that property over to the state until its rightful owner is located.

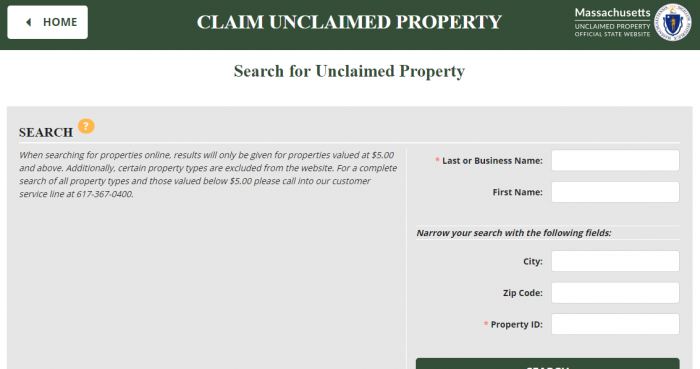

In Massachusetts, you can search for property valued at $5 and above on the commonwealth’s findmassmoney website:

If you are looking for property that is valued under $5.00, you can contact the customer service line at 617-367-0400 for a complete search of all property types.

The one downside to Massachusetts and other states having such user-friendly unclaimed property search databases is that, when many people begin the unclaimed money process, they incorrectly assume that using their state database will result in a complete unclaimed property search. However, each state (or commonwealth) database only has results for that state. Most people have business or financial contacts out of the state. If you or your ancestors ever lived in another state, you may have unclaimed property there. If you had an employer or an insurer that was headquartered in another state, you may have unclaimed property in that state, as well. Finally, some types of property do not revert to state custody, even in the state where the person is documented to have resided. Examples of these types of property include federal income tax returns and U.S. Savings bonds. Therefore, a complete unclaimed property search needs to include federal databases in addition to state databases.

It can be overwhelming to realize that you are going to have to look at multiple sites to run a complete asset search. However, it is important to keep in mind that each of the sites you will search has done its best to simplify the search process and the claim process. While it may become tedious, it should not be difficult.

What is Unclaimed Money?

Unclaimed money is any financial asset that has been abandoned by its owner. For property to be abandoned, there has to have been no activity by the property owner for an extended period of time. In addition to the term unclaimed money, you may also hear it referred to as unclaimed property, abandoned money, and abandoned property. Examples of unclaimed property include: savings accounts, checking accounts, certificates of deposit, unpaid wages, unpaid commissions, uncashed dividends, stocks, underlying shares, customer deposits, customer overpayments, credit balances, refunds, paid-up life insurance policies, safe deposit box contents, money orders, traveler’s checks, uncashed benefit checks, and gift certificates. Unclaimed property only refers to personal property and does not include any type of real estate, including land or any improvements on the land.

How Much Unclaimed Money is in Massachusetts

It can be difficult to pinpoint how much unclaimed property is in each state because with property being claimed each day and other property being reported, the amount is constantly in flux. However, there is currently more than $2 billion in unclaimed property in Massachusetts. Of course, the people of Massachusetts may actually be entitled to a lot more unclaimed property, since they may also have unclaimed assets in federal locations or in other states. When looking at the United States as a whole, there is a massive amount of unclaimed property available. According to the National Association of Unclaimed Property Administrators (NAUPA), a nationwide organization devoted to caring for unclaimed property, there is around $42 billion in unclaimed property in the United States.

Massachusetts Unclaimed Money Finder

Massachusetts operates an unclaimed money finder at www.findmassmoney.com:

The state database has information for all of Massachusetts’ fourteen counties: Barnstable, Berkshire, Bristol, Dukes, Essex, Franklin, Hampden, Hampshire, Middlesex, Nantucket, Norfolk, Plymouth, Suffolk, and Worcester. Therefore, you only need to run a single search to search the entire state.

To begin your search, you need your last name, business name, or property ID number:

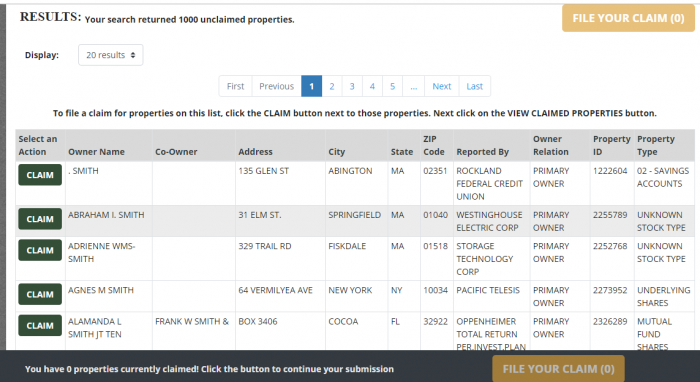

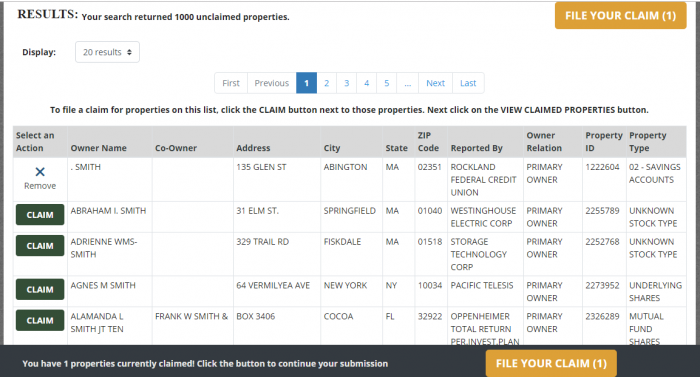

While some sites make you search by first and last name, in Massachusetts, you can run a name using only a last name. This can be helpful, since people may have used nicknames, aliases, initials, or middle names when opening an account. Running a search by last name lets you look at all possible results, which can help you find more property. That said, if you have a common last name, a last-name only search can return so many results that it is burdensome to look through them. For example, running a last-name search for the common surname Smith provided more than a 1,000 results:

However, what Massachusetts does, which not all states do, is provide address and city information for each of the results, as well as the reporting agency, the property relation, the property i.d., and the property type. Therefore, you can easily scan through the search results to see if they match any of the possible names, possible addresses, or financial institutions that you might want to include in your search.

Once you identify a claim that you believe is yours, you can hit the claim button next to that property. It will then mark that claim with an “x” by it, and you can continue looking for additional properties that you believe you can claim:

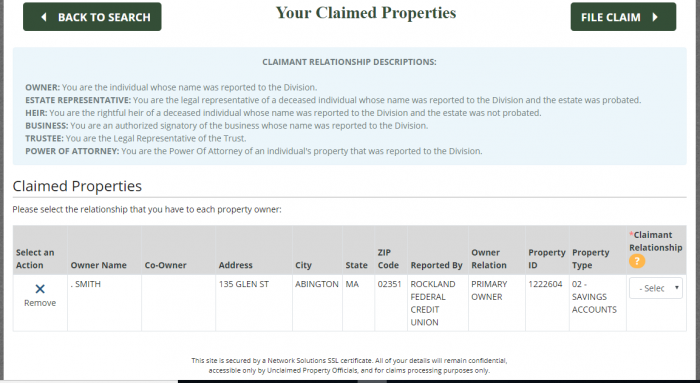

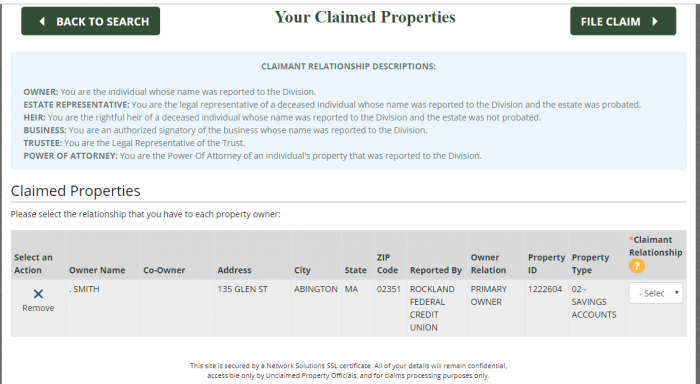

After you have identified all the properties you wish to claim, you hit the “file your claim” button at the top or bottom of the screen. That will take you to a page that lists all of the properties you are claiming:

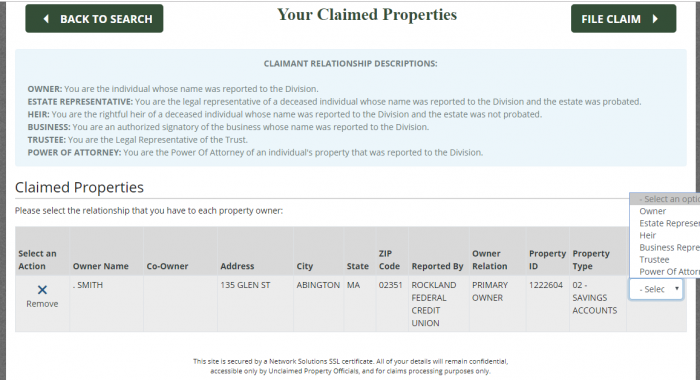

For each property, you will be asked to identify your claimant relationship:

This is a very important step, because the type of relationship helps determine the type of documentation you will need to provide to proceed with your claim.

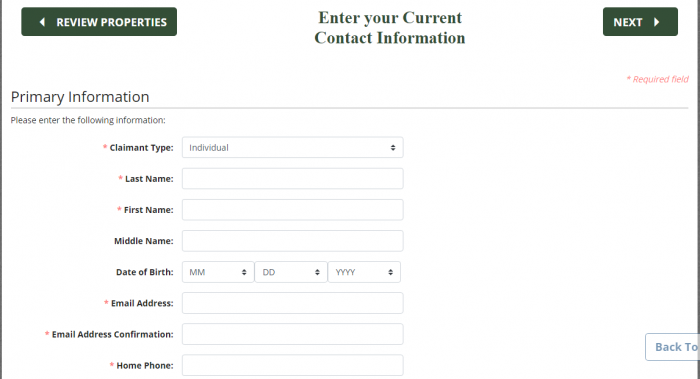

Then, you will be asked to enter your current contact information, including your Social Security Number. While you do not have to provide a Social Security Number to process your claim, doing so greatly simplifies the process and you may be required to provide it before your claim will be paid:

Once you have provided your contact information, you will be given detailed instructions for each claim, including the type of documentation that you need to provide proof for your claim and instructions for submitting that documentation.

Unclaimed Money Laws in Massachusetts

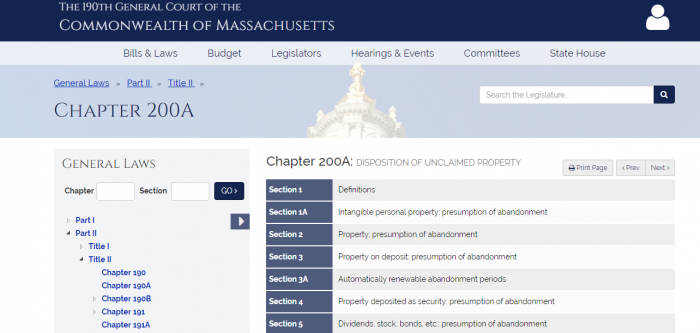

In Massachusetts, the abandoned property law is found at Massachusetts General Laws Chpt. 200A:

Massachusetts Unclaimed Money FAQ

How long does Massachusetts hold unclaimed money?

The Commonwealth of Massachusetts holds property indefinitely, but does auction tangible property and then hold the proceeds for the actual owners.

Examples of Unclaimed Money

Just about any type of personal property that has value can result in the unclaimed property fund, as long as someone has given it to a third-party for safekeeping. Not all of those safekeeping relationships are clear-cut; for example, funds deposited with a court but not used can end up as unclaimed property. In addition, private contracts between a property owner and a holder can result in the property reverting to the holder, rather than being classified as unclaimed property. For example, pawned property that is not redeemed, items left in rental homes, and items left in storage units generally become the property of the holder, according to the terms of the parties’ contract. In addition, real property is never considered abandoned property for the purposes of this law.

Some examples of unclaimed property include: bank accounts; certificates of deposit; unpaid wages and commissions; uncashed dividends; stocks and underlying shares; customer deposits, credits, refunds, or overpayments; paid-up life insurance policies; safe deposit box contents, money orders; traveler’s checks; uncashed benefit checks; and gift certificates.

Does state of MA make efforts to locate owners?

Yes. attempts to locate owners and send them notifications of unclaimed property. The Unclaimed Property Division publishes the names of all new owners who have assets valued at $100 or more throughout the Commonwealth and sends letters to the owners at their last known address, as well as operating an outreach program that send Unclaimed Property staff to various events throughout the commonwealth to educate people about the program.

Other sources to search besides MA state database?

Remember when we said that a thorough search is going to include sites other than your own state’s unclaimed property database? Here is where we help you make a comprehensive list of some of the other places you should look.

Think about what states could be holding unclaimed property for you. Obviously, you want to include any state or territory where you ever resided, even as a child. However, you might not think to include states where your relatives resided. In addition, keep in mind any state where you may have had business contacts, such as an employer or an insurer who was headquartered out of state. Also think about locations where you may have purchased money orders, traveler’s checks, or gift cards.

Once you have finished your state list, then make sure and include these four important nationwide sites: the U.S. Treasury, the IRS, the National Pension Benefit Guaranty Corporation, and the Life Insurance Policy Locator Service.

The U.S. Treasury does not handle all financial transactions between the federal government and individuals, but it is one of the biggest holders of unclaimed property in the United States because of savings bonds. The U.S. Treasury has over $17 billion in unclaimed savings bonds. They used to have a very easy way to find and claim abandoned savings bonds, but they discontinued that process. While it is still possible to find and claim those bonds, it is more time consuming. You can find out more information at the Treasury Direct website, by contacting them at 844-284-2676, or by writing to the Bureau of Public Debt.

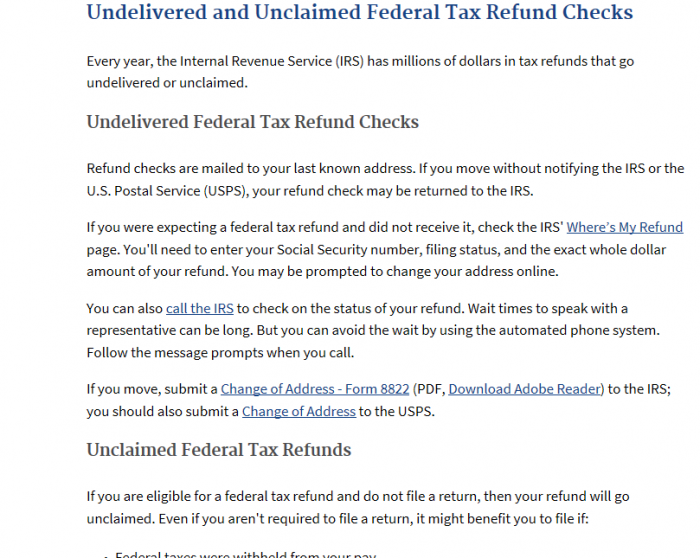

Although many people do not think of the Internal Revenue Service as a source for money, it sends millions of checks to taxpayers each year. What you may not know is that the IRS does not forward tax refund checks, and it never turns over uncashed or returned checks to the states:

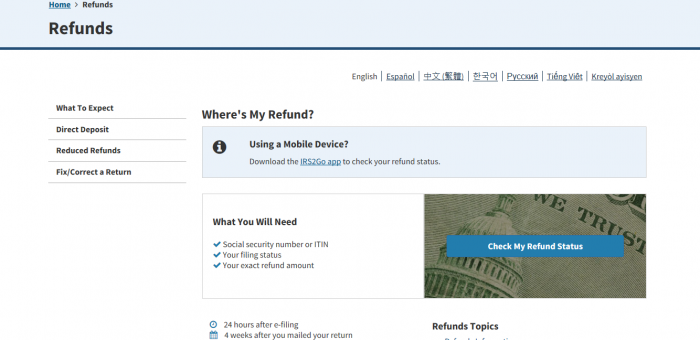

Therefore, you should look at the IRS when looking for missing money. In fact, if you think that you have a refund that was not paid, they even have a Where’s My Refund? page that it set up to help you track your missing refund money:

Although many companies no longer offer them, pensions used to be an important part of a company’s compensation package. Did you know that pensions are guaranteed by the federal government? Many workers approaching retirement age may not even be aware that they have pension money waiting to be claimed. Fortunately, the Pension Benefit Guaranty Corporation, the federal agency that guarantees private pensions, operates a database that allows people to search for missing pension benefits. It is well worth the effort; the PBGC has 70,000 potential claimants with over $400 million in unclaimed pension benefits.

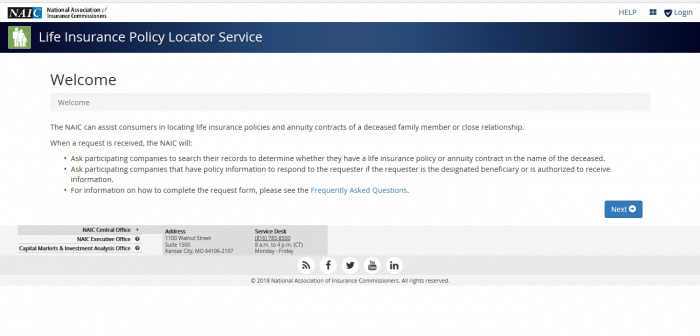

Although it is not a federal website, another nationwide resource that you should know about when looking for missing money is the National Association of Insurance Commissioners’ Life Insurance Policy Locator Service. Unpaid life insurance proceeds frequently do not make it into state unclaimed money databases because the insurer might not have any location information for a beneficiary. While this service does not operate like a state searchable unclaimed money database, it does allow you to input your personal information, so that member life insurance companies can check to see if you are the beneficiary on any of their unpaid claims.

How do I make sure my heirs know where my assets are if I die?

Running an unclaimed property search is something many people find themselves doing after a death of a loved one. That leads people to wonder how they can avoid putting their heirs in the same situation. The most important thing to realize is that you need more than a will. A will does not tell where your assets are located, just how you want them distributed. You need to make sure that a trusted individual has access or knowns how to access your complete financial records in the event of your death or incapacitation. Do not forget to provide keys, address information, and unit number for any safe deposit boxes or storage units!

How can I prevent my property from becoming lost or unclaimed?

The old expression “an ounce of prevention is worth a pound of cure” is certainly applicable when it comes to unclaimed money. The best way to make sure that your property is never lost is to make sure and keep track for any money that you have out there. However, that is easier said than done, because many parts of daily life require deposits or result in credits.

Our first tip is to establish an email address, which is not linked to any employers, and that you use for all of your financial accounts. Then, select electronic banking when you open new accounts and move any existing accounts over to electronic account services. This will provide you with a central location for all of your financial information. Just make sure that a trusted individual has access to that account, in case you die or are incapacitated.

Next, make updating your address, phone number, or name a priority whenever any of those details change. You may even want to schedule a day each year to review your financial records and ensure that all of your information is updated with any organization holding your money.

Speaking of financial records, detailed financial records are important. Create a file that has all of your detailed financial information. For every account, you want to include the following information: the name of the financial institution or other holder; the name you used to open the account; the account numbers; the date you opened the account; when deposits are due back to you; the amount of the account of deposit; the physical address of the holder; and phone numbers for the holder. If the property is physical property held in a physical location, such as a storage unit or safety deposit box, include the address and other identifying information, and a key to the unit. This may seem like a difficult process, but it can be as easy as going through your bills and account statements, taking a picture of the information at the top of the bill, and adding that to a digital file of your records!

Should I hire a finder to conduct the search?

We get this question a lot, but it is not one that we can answer for you. A finder service is a third party service that will search for your unclaimed money and claim it for you, generally in exchange for a percentage of any property that they find. Legitimate finder services can be great for people who are too busy to run their own searches. However, it is also true that you can do anything a finder service can do, for free, if you have the time. Whether or not you should use a finder service really comes down to whether you have the time and inclination to run your own search.

One important thing to keep in mind is that you will have to give a finder service a substantial amount of personal information if you hire them to find your assets. This puts you at risk for identity theft, so never respond to unsolicited offers to use finder services, and check out a service’s legitimacy before hiring them!

Why does Massachusetts take possession of unclaimed property?

Many people wonder why states take possession of unclaimed property, instead of leaving it with the holder. The presumption is that if you stop contacting the holder and do nothing with the property, you have forgotten about it or abandoned it. The holder gets to use that money to make money for themselves until you claim it. That means they do not have an incentive to find you and get your property to you. Massachusetts takes possession of the property in order to find the original owners. They also get to use the money to make profit until it is claimed.

Conclusion

Looking for lost property is a little like hunting for treasure. Not everyone out there has abandoned property, but some people have pretty significant amounts of property out there, just waiting to be claimed. Good luck in your search!