Contents

Looking for lost money in Michigan? Fortunately, finding unclaimed money and property in Michigan is easy, thanks to the state’s unclaimed property website. However, running a search for unclaimed money might start with looking at a state’s website, but it should not end there. Instead, a complete unclaimed property search should include searches of all states where the property owner resided, states where the property owner had business connections, and even national databases.

Search Public Records

Although it may be time-consuming to run your own unclaimed property search, it should not be complicated. The widespread availability of state unclaimed money databases and several well-designed federal databases make it easy to locate most of the common sources of unclaimed money. We have created this overview of the process for finding and claiming unclaimed money to further simplify the process. Read on to find out important information, such as the definition of unclaimed money; why unclaimed money databases exist; the databases you should search to find unclaimed property; how to run an unclaimed property search; how to claim unclaimed money; whether it is worth it to use a “finder” to locate and claim unclaimed money and property for you; and helpful tips about how to avoid having unclaimed money in the future.

Michigan is one of the states or territories that participates in the Missing Money website. Missing Money, which you can find at www.missingmoney.com, is a website that allows you to simultaneously look for unclaimed property in several different states and territories at the same time. The states and territories that participate in the Missing Money program include: Alabama, Alberta Canada, Arizona, Arkansas, Colorado, District of Columbia, Florida, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, West Virginia, and Wisconsin.

Michigan’s Unclaimed Property Finder

We suggest you have the following information available for each person for whom you are running a property search: full name, any other names you have used, maiden names, prior married names, current address, previous address, social security number, list of former employers, list of insurers, list of unions or other professional organizations. Even if you are searching for yourself, making a list ahead of time can help you ensure that you have all information available and that it is easy for you to access.

While you can run a search for anyone for whom you have the above information, keep in mind that you may not be able to claim property on their behalf. To claim property for another person, you will need to be able to provide documentation proving that you have the right to claim the property. If the person is deceased, you may need to provide a death certificate and proof that

Once you have collected all of the information you need to run the search, make a list of databases that you want to visit. You want to run searches in every state in which the person resided. You can find those databases by looking for the state treasury website for those states. If you cannot find a treasury website, keep in mind that treasurers may also be known as comptrollers, controllers, or financial officers. In addition, make a list of the federal databases you want to check. We suggest always checking the I.R.S., the Treasury, and the pension websites.

Another thing to keep in mind is that databases can have errors. Try being creative when running the property search. Look by last name and scan all of the accounts to make sure you have not missed one because you opened the account in a different name or using an initial. Do you have a name that is commonly mistaken or misspelled? If so, make sure and run checks using those variants, as well.

Michigan Unclaimed Property Database

Running a statewide unclaimed property search used to mean looking at every county in the state individually. Fortunately, you no longer have to look county-by-county to find unclaimed money in Michigan. Imagine having to look through individual databases for all of these counties: Alcona, Alger, Allegan, Alpena, Antrim, Arenac, Baraga, Barry, Bay, Benzie, Berrien, Branch, Calhoun, Cass, Charlevoix, Cheboygan, Chippewa, Clare, Clinton, Crawford, Delta, Dickinson, Eaton, Emmet, Genesee, Gladwin, Gogebic, Grand Traverse, Gratiot, Hillsdale, Houghton, Huron, Ingham, Ionia, Iosco, Iron, Isabella, Jackson, Kalamazoo, Kalkaska, Kent, Keweenaw, Lake, Lapeer, Leelanau, Lenawee, Livingston, Luce, Mackinac, Macomb, Manistee, Marquette, Mason, Mecosata, Menominee, Midland, Missaukee, Monroe, Montcalm, Montmorency, Muskegon, Newaygo, Oakland, Oceana, Ogemaw, Ontonagon, Osceola, Oscoda, Otsego, Ottawa, Presque Isle, Roscommon, Saginaw, St. Clair, St. Joseph, Sanilac, Schoolcraft, Shiawassee, Tuscola, Van Buren, Washtenaw, Wayne, and Wexford.

What is Unclaimed Property?

The terms unclaimed money and unclaimed property are actually misnomers. They might give the impression of money or property that is without an owner and is up for anyone to claim. In reality, unclaimed property does have an identified owner. However, the holder of the money, which can be a bank or other financial institution or simply a business that holds money in the course of its operations, has lost the ability to contact the owner. This lack of contact must be for a statutory period of time. Once that time has passed, the money is considered unclaimed.

Once money or property is considered unclaimed, it is transferred to the state. The state does not take ownership of the property, but instead acts as a trustee for the real property owner. However, the state is allowed to use the interest and other earnings from the property.

Not all unclaimed money can be located in state unclaimed property databases. Some types of unclaimed property will never revert to the states. Generally, this is property held by the federal government, including agencies like the Internal Revenue Service and the U.S. Treasury. Other property may be held by a private business that is unable to locate the state where the original owner resides: pensions and life insurance policies often fall into that broad category.

How Much Unclaimed Money in Michigan?

Nationwide, there is a surprisingly huge amount of unclaimed money and property. The number is in constant flux because of the nature of unclaimed property, but it hovers around $42 billion according to the National Association of Unclaimed Property Administrators (NAUPA).

There are hundreds of millions of dollars in unclaimed property in Michigan. There are at least a million different properties that are not claimed. So far, the largest claim was $2.4 million dollars. In addition, there is physical property in the unclaimed database. However, property is only hold for three years, and then it is auctioned, with the proceeds held for the property owner.

Search Public Records

Michigan Unclaimed Money Finder

Michigan Unclaimed Property Finder

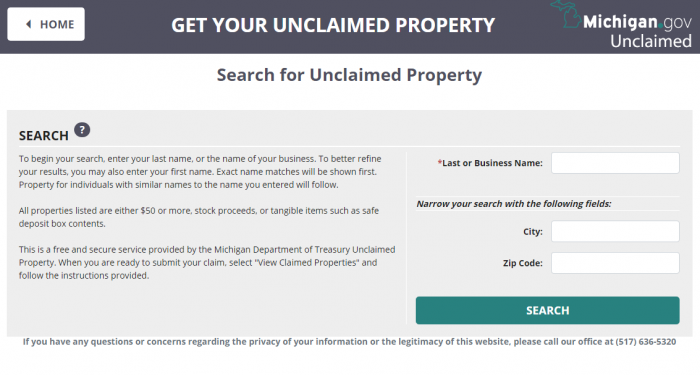

At this site, you can use last or business name to run a search. You can also use city or zip code to narrow down your search results.

If you have looked at any of our other tutorials, then you already know that we use the name Bob Smith for our tutorials. We choose a common name because there are some pitfalls that can happen with a search for a common name. We also use the same name to make it easy to follow the steps of the tutorial and compare the tutorials. We start with searching for the last name Smith:

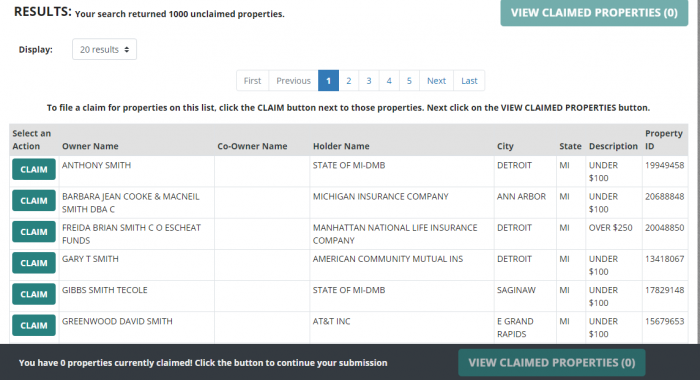

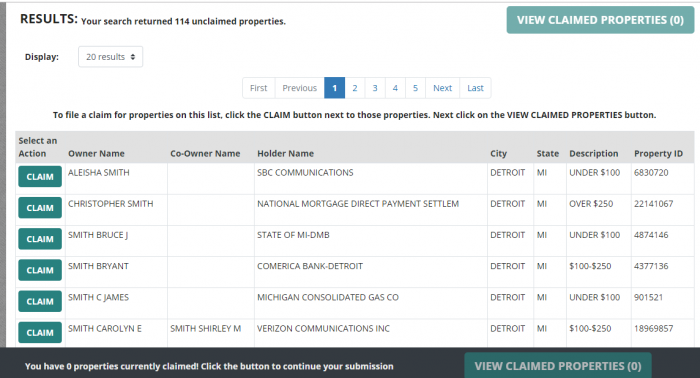

The results show over 1,000 different results. This is not a workable number of potential search results. However, you cannot narrow down the search results by adding a first name. Therefore, we suggest immediately going to the next step, which is adding a city or a zip code to the search. We chose to add Detroit to the search results:

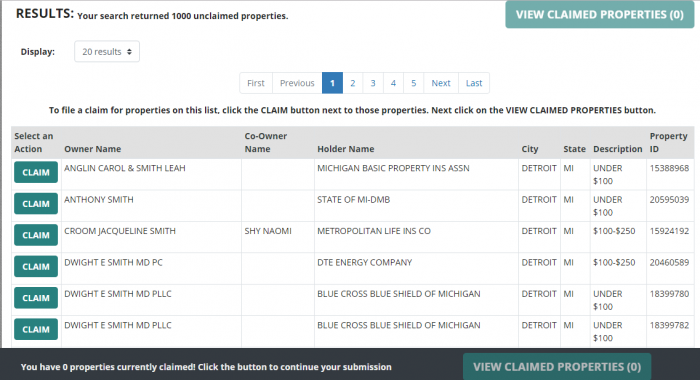

This did nothing to reduce the number of potential results, but instead leaves over 1,000 potential properties. In addition, the results are not necessarily in pure alphabetical order. This makes it seem like we may have to use zip codes to really narrow down potential results in Michigan. We chose to use 48209 and Detroit. This took us down to 114 unclaimed properties.

While none of them are Bob Smith, the list contains Robert and Bobby. You can claim them by clicking the claim button to the left of the property record. You will see a screen with only the properties you selected:

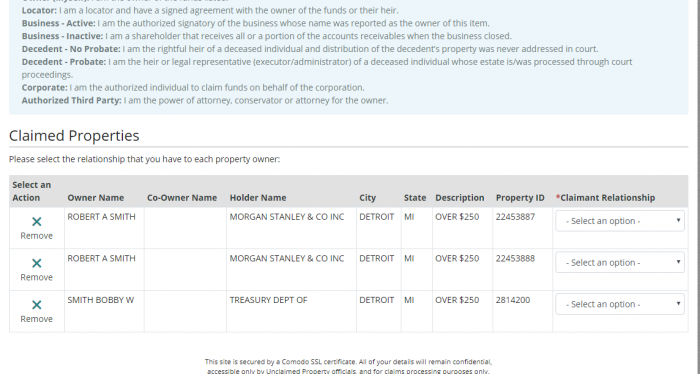

You are asked to select a relationship to the claim. Relationships include: owner, locator, active business, inactive business, decedent (probate and no probate), corporate, or authorized third party.

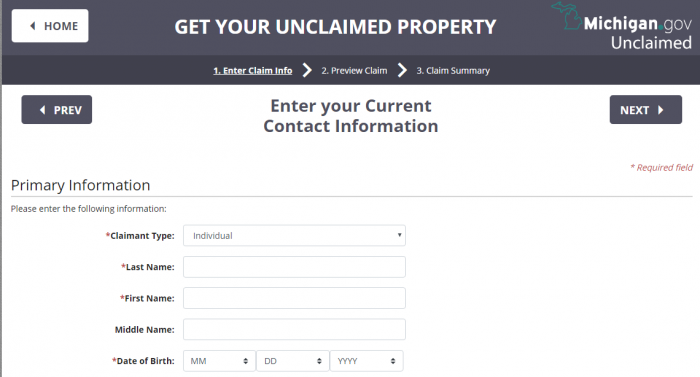

Once you have selected the claimant relationship, you can hit file claim on the top of the page. Once you do that, you are asked to fill in a claim form:

In addition, you can also file an unclaimed property inquiry form. This form allows the state to search for property using additional information, which can be helpful if you have a common last name or are searching on behalf of another person.

Once you have located unclaimed property, you may be able to claim it using the unclaimed property inquiry form. At the bottom of the form, the state provides very explicit instructions about the types of information that you need to include to make claims for yourself, for your business, on behalf of a living person, and for a deceased. You may also need to submit additional forms, depending on the types of property.

Unclaimed Property Laws in Michigan

Michigan’s unclaimed property law is the Uniform Unclaimed Property Act, Public Act 29 of 1995, Michigan Compiled Laws §§ 567.221-537.265. This statute covers what type of property is considered unclaimed, and when holders of property must report unclaimed property to the state. The act contains an appendix with a dormancy chart, because different types of property have different dormancy periods before being considered unclaimed. Generally, in Michigan the dormancy period is three years, but uncashed payroll checks and property held by government entities all have a one-year dormancy period.

Michigan Unclaimed Property FAQ

How long does Michigan hold unclaimed property?

Michigan will hold unclaimed money for the actual owners until it is claimed.

Examples of Unclaimed Property

While you may think of unclaimed property or money being something that only happens with banks or other financial institutions, the reality is that almost all businesses have unclaimed property as a result of normal business operations. Any asset, tangible or intangible, that belongs to a third party but is in the custody of the business can be considered unclaimed property. Typical examples or unclaimed property are savings and checking accounts, but unclaimed wage or payroll checks are another popular type of unclaimed property. In addition, deposits for a wide variety of businesses are also unclaimed property.

Does Michigan make efforts to locate owners?

The State of Michigan does not make efforts to find the rightful owners of property. However, that is because there is a built-in system that requires efforts to locate rightful owners before property is ever turned over to the state. First, the property has to be dormant for the period of time specified in the unclaimed property manual. Then, the business’s efforts to contact the owner must fail.

Other sources to search besides the Michigan unclaimed property database?

For most people, the search for unclaimed property and money begins by searching the database of the state where the person resides. However, you do not want to limit yourself to a search of your current state database. Make sure and look at the unclaimed property databases for states where you formerly resided. In addition, if you have had an employer that was headquartered in another state or other business ties, such as a professional association membership, with an entity headquartered in another state, make sure and search the state where that business is located.

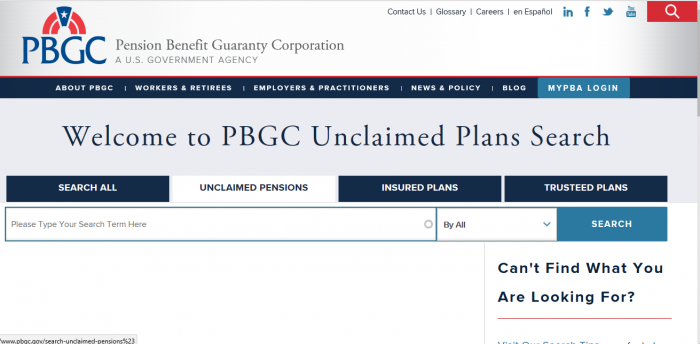

Once you have covered all of the state databases, you do not want to forget the national databases. Unclaimed property searches should always include these, because some types of unclaimed property are never turned over to state databases. The I.R.S. is a significant source of unclaimed money because it holds onto income tax returns that are sent back to it and not cashed. The U.S. Treasury has unclaimed savings bonds. The Pension Benefit Guaranty Corporation is a federal agency that guarantees pensions within the United States and can help people locate unpaid pension benefits.

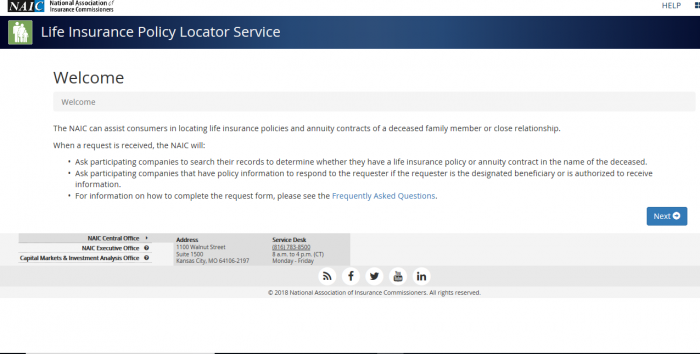

You may also look at some private databases for unclaimed property. One significant source of unclaimed property claims is life insurance, but life insurance agencies may be unable to locate the state of the actual owner. There is no single database that holds information for all unpaid life insurance claims, and many life insurance conglomerate databases are not searchable. However, you can provide information to some of these databases.

While the steps to finding unclaimed money are the same whether you are running it for yourself or on behalf of another person, you will probably have to spend more time information-gathering if before the search if you are running it on behalf of someone else. While you can run searches with incomplete information, you may not find all unclaimed property or you may have to spend longer periods of time searching because of the incomplete information.

If you have read this far, then you already know that the state databases are not the only place to find information on unclaimed money and property. Here are the top places to look for money outside of the state databases:

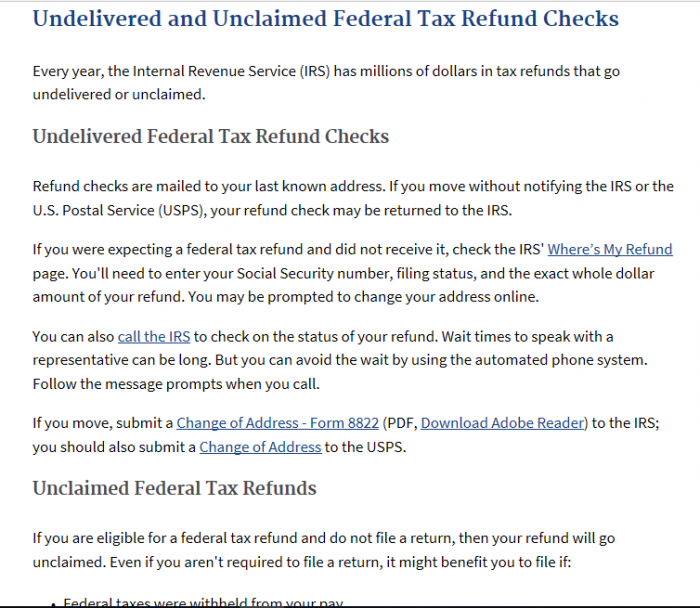

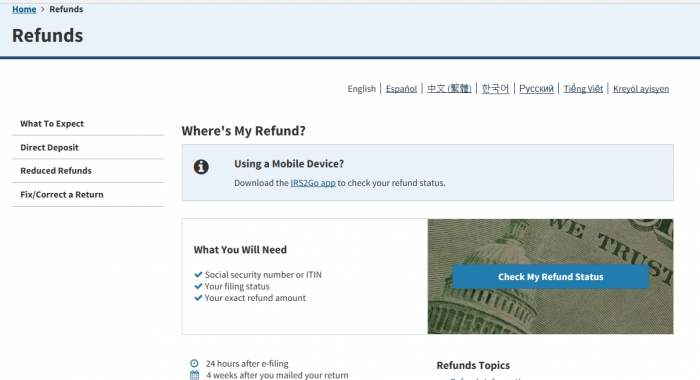

The IRS. Everyone is familiar with the Internal Revenue Service, but you may not realize that the IRS is a significant source for unclaimed property. It holds all taxpayer revenues and those revenues, including unpaid income tax returns, never revert to the states. Instead, the IRS holds unclaimed property for claimants. You can find out more about this policy at the IRS website:

You can look for your refund information on the IRS’s Where’s My Refund? page:

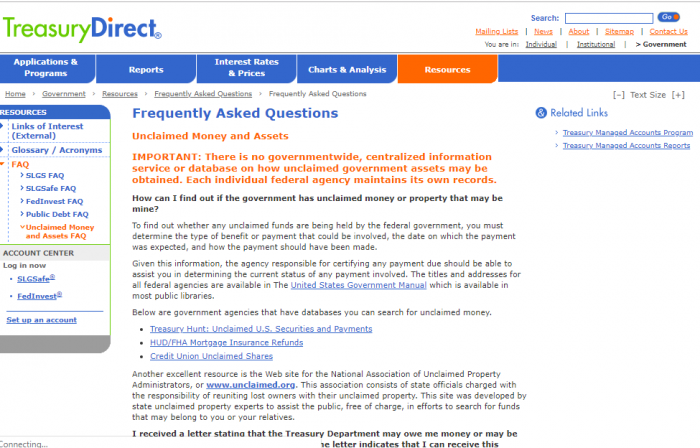

Many people have Treasury bonds. In fact, many people have Treasury bonds and do not realize it because they are popular gifts for births and other special occasions. Locating lost Treasury bonds can be a complicated process, because the Treasury no longer operates its simple location database. However, that does not mean that you cannot still file claims for lost bonds. To find out more information, contact the Treasury by visiting the Treasury website, Treasury Direct, or calling them at 844-284-2676.

Although pension benefits are held by private companies, they are guaranteed by the federal government. The Pension Benefit Guaranty Corporation, is the guaranteeing agency and can even help you locate unpaid pension benefits. Their online database is searchable by: last name, employer name, state where the employer was headquartered. Even if you do not think you have unclaimed pension benefits, we strongly suggest running a search; there is an unpaid benefit claim worth close to $1 million right now, and over 70,000 potential claimants. The total amount of unclaimed benefits is over $400 million.

If you think that you may be the beneficiary of an unclaimed life insurance policy, you may need to look through the state databases of all 50 states to find that information. The time spent might be worth it; 1 in every 600 Americans is the beneficiary of an unpaid policy. Want to simplify the process? The National Association of Insurance Commissioners’ Life Insurance Policy Locator Service does not have a searchable life insurance beneficiary database, but it does allow you to submit your information so that its member companies can search their records and see if they have any policies matching your information.

Other possible sources of unclaimed property include: the FDIC, the Department of Housing and Urban Development, the National Credit Union Administration , and the Veteran’s Administration Benefits Department.

What is the best way prevent my property from becoming lost or unclaimed?

Although finding unclaimed property can be a nice surprise, most people agree that the best thing would be to never lose the property in the first place. One major reason for this is that the state gets to keep the interest and earnings from unclaimed property. Therefore, we provide some helpful tips to help you prevent your property from being categorized as unclaimed in the future:

It is important to keep detailed records of your financial transactions, and to make sure that a designated person has access to your records in the event that your die or are incapacitated. The type of information you should keep with those records includes: the name of the business holding your property, the type of property they are holding, account numbers, the names in which accounts are held, and the expected due dates of any deposits. If you have a safe deposit box, ensure that the physical location and box number of the safety deposit box are in your financial records, as well as a second key to the box.

Whenever possible, we encourage you to use electronic account management services. These services, which are often linked to your email address, are easier to keep track of when you are moving than accounts with paper statements.

How do I make sure my heirs know where my assets are if I die?

While having a will is an important first step to making sure that your loved ones get your property when you die, you need more than a will. Make sure that your executor or administrator has access to all of your financial records and the information that he/she needs to access those accounts. In addition, if you have any life insurance policies, make sure that the beneficiaries or the executor of your estate knows where the life insurance is located, the amount of the policies, and the named beneficiaries.

Should I hire a finder to conduct the search?

You may be contacted by an organization or an individual offering to search for unclaimed property for you and claim it on your behalf, in exchange for a percentage of the property. These services are called finders. The decision whether or not to hire a finder is a personal one. Because they charge a percentage of the claim, you will get less money than if you run the claim yourself. However, the claim process can take time, and, if you do not have the time, the finder can locate money you would not otherwise have. If you do choose to use a finder, make sure you understand the percentage the finder will charge and your rights and obligations under your business agreement.

Why does Michigan take possession of unclaimed property?

The State of Michigan operates an unclaimed property register for several reasons. The purpose of the Michigan Uniform Unclaimed Property Act is to protect unclaimed property and return it to its rightful owners of the owners’ heirs. The state does this by having the State Treasurer take custody of the property and hold it until the original owner can claim it. This can be critical because, in the past, if the original holder of the property went out of business, the original owner would have lost the property. In addition, by keeping all unclaimed property in a central location, the register simplifies the search for lost property.

Conclusion

Should you run an unclaimed money search? We think the answer is yes. There are billions are dollars in unclaimed property and money out there; some of it may be yours.