Contents

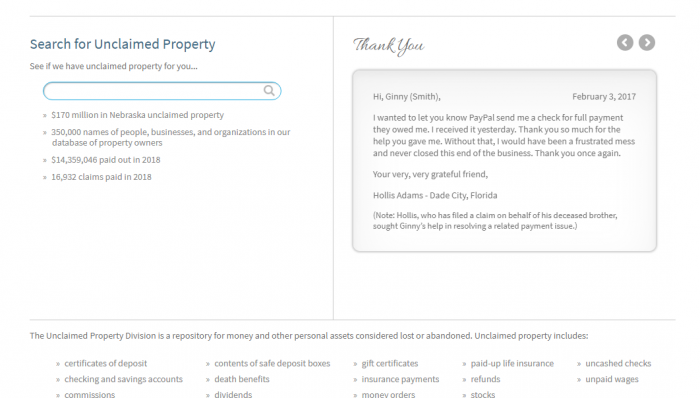

In Nebraska, the unclaimed property program is handled by the State Treasurer. The current Nebraska State Treasurer is John Murante. Nebraska has over $170 million in unclaimed property. Nebraska has over 350,000 names of people, organizations, and businesses on its unclaimed property list. It paid out over $14 million in 2018. They paid out almost 17,000 claims.

Like other states and territories with unclaimed property programs, Nebraska thinks of its program as a consumer protection program. That is because they use the program to reunite the actual owners of property with that property. Before the advent of unclaimed property programs, many holders would not make diligent efforts to locate property owners because they could use the property to create profits for themselves. However, when states have unclaimed property programs, there is a central location for property owners to look for their abandoned or lost property.

Some examples of unclaimed property include the following type of assets: checking accounts, savings accounts, certificates of deposit, commissions, wages, dividends, death benefits, gift certificates, contents of safe deposit boxes, insurance payments, paid-up life insurance, money orders, stocks, refunds, and uncashed checks.

Nebraska makes a variety of different types of efforts to reunite property owners with their property. These efforts are not limited to the state’s unclaimed property database. For example, it also publishes a yearly unclaimed property report. One-in-five people in Nebraska has unclaimed property. You can also check to see if you are one of them by calling 402-471-8497 or at their toll-free number, which is 877-572-9688.

Nebraska does not use the Missing Money website for its unclaimed property searches. Instead, it operates its own database for unclaimed property.

If you are like most people, you might find the idea of an unclaimed property search to be a little intimidating. While this is understandable, you will be happy to find out that the unclaimed property search process is actually pretty simple. That is because states like Nebraska have done their best to simplify the process. Many states use the Missing Money database to run their searches. This process simplifies things because it allows you to search multiple states at a single time. Nebraska does not use the same website to run their searches, but it does use a similar process. As a result, many people feel like they can handle searching in any state once they have mastered a single state. Do not worry if you are not among them; we are completing our collection of easy-to-follow tutorials, so that you can get extra guidance from us.

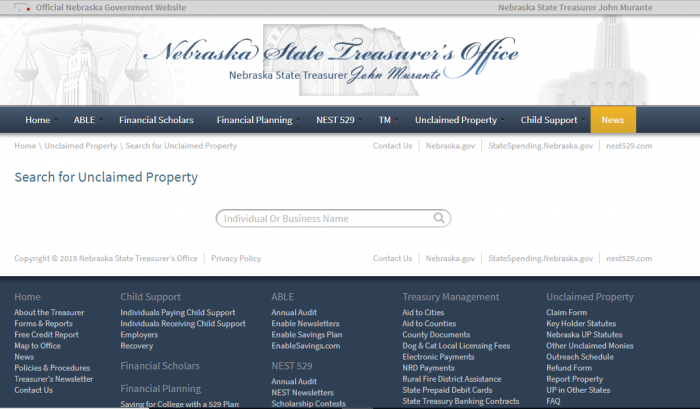

Begin your Nebraska unclaimed property search at the state’s unclaimed property website.

Nebraska’s search box is very simple compared to what you may find in other states: it does not have any parameters other than individual or business name.

We used an alias to go through a search on the website, and have created a step-by-step tutorial so that you can understand exactly how to search for abandoned property in Nebraska. This complete guide to finding and claiming unclaimed property in Nebraska also answers some of the most frequently asked questions we get about the process. In it, you will find: the web address and links for Nebraska’s unclaimed money database, as well as a link to the yearly unclaimed property report that is published by the state; links to the state’s unclaimed property law; information about finder services; what documentation you may need to prove your claim; and how to tailor your search.

Nebraska’s Unclaimed Property Database

Before states decided to create statewide unclaimed property databases, many counties had their own way of tracking abandoned property and trying to return it to its owners. This could be an extremely complicated system, requiring you to literally look at hundreds of different counties, depending on the state, in order to try to locate your lost money. Fortunately, Nebraska has a state-wide database, which lets you simultaneously look for lost property in all of the following states: Adams, Antelope, Arthur, Banner, Blaine, Boone, Box Butte, Boyd, Brown, Buffalo, Burt, Butler, Cass, Cedar, Chase, Cherry, Cheyenne, Clay, Colfax, Cuming, Custer, Dakota, Dawes, Dawson, Deuel, Dixon, Dodge, Douglas, Dundy, Fillmore, Franklin, Frontier, Furnas, Gage, Garden, Garfield, Gosper, Grant, Greeley, Hall, Hamilton, Harlan, Hayes, Hitchcock, Holt, Hooker, Howard, Jefferson, Johnson, Kearney, Keith, Keya Paha, Kimball, Knox, Lancaster, Lincoln, Logan, Loup, McPherson, Madison, Merrick, Morrill, Nance, Nemaha, Nuckolls, Otoe, Pawnee, Perkins, Phelps, Pierce, Platte, Polk, Red Willow, Richardson, Rock, Saline, Sarpy, Saunders, Scotts Bluff, Seward, Sheridan, Sherman, Sioux, Stanton, Thayer, Thomas, Thurston, Valley, Washington, Wayne, Webster, Wheeler, and York.

Search Public Records

What is unclaimed money?

Unclaimed money, which may also be known as unclaimed property, abandoned money, or abandoned property, is money that the property owner placed in the possession of a holder, but the holder is unable to contact the property owner. Property becomes unclaimed for a number of different reasons, but usually because the property owner forgets that the property exists. The property owner may forget about an account and stop having activity on it, forget to cash a check, or forget to collect a deposit. Once the property is forgotten, after a statutory period of time, the holder tries to contact the property owner and is unable to do so, the holder has to report it to the State Treasurer and remit the property to the State Treasurer for their custody.

Unclaimed property does not include land, taxes, or motor vehicles. Some examples of unclaimed property include: insurance claim payments, security deposits, wages, vendor payments, security deposits, utility deposits, safe deposit boxes, stocks, miscellaneous outstanding checks, bonds, gift certificates, dormant checking accounts, dormant savings accounts, rebates, and the contents of safe deposit boxes.

How Much Unclaimed Money is in Nebraska?

Nebraska has $170 million in unclaimed property. They have 350,000 potential claimants; these claimants include organizations, businesses, and people. In 2018, they paid out over $14 million in claims. There were almost 17,000 claims paid. Nebraska’s portion of the unclaimed money in the United States is relatively small; according to the National Association of Unclaimed Property Administrators (NAUPA), there is more than $42 billion in unclaimed property available throughout the various states and territories in the United States.

Nebraska Unclaimed Money Finder

Start your search for unclaimed property at unclaimed property search page on the Nebraska State Treasurer’s website.

In Nebraska, you begin your search by entering in an individual or business name. You can use a full name or simply a last name. Nebraska does not give you the option of including other parameters in your search, in the address.

For this search, we are using the same name we use in our other tutorials: Bob Smith. This name is chosen on purpose because it is common. It will probably ensure positive search results. It will also help you see some of the potential pitfalls of searching for common names, because you may get too many results, and help you incorporate strategies to avoid those pitfalls.

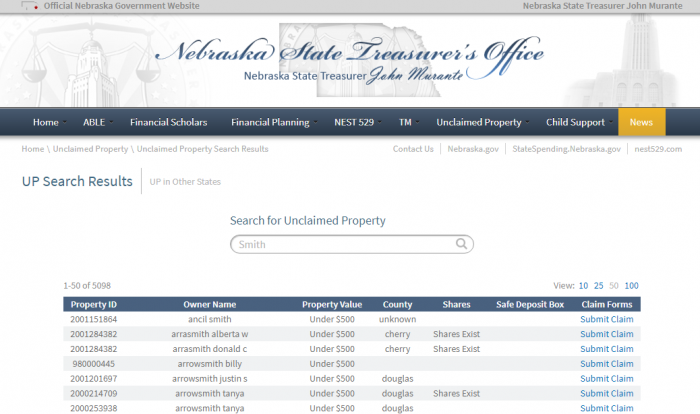

We begin the search by looking only for the last name “Smith.” There are over 5,000 results if you search by last-name only:

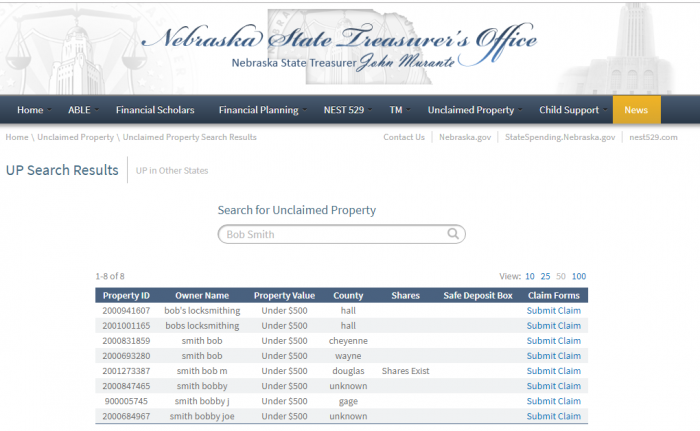

There are so many results that can be overwhelming. To narrow them down, you can try running the search including the first name, so that you are looking for “Bob Smith” instead of just the last name Smith:

There are only 8 results when searching for the whole name. This will make searching much less difficult than thousands of search results.

When you look at the search results, you see that each entry has: a property id number, an owner name, the property value, the shares, whether it is the safe deposit box, and the words “submit claim” for submitting a claim. This is less information than you may find in other states, where address and type of property may be indicated in the search results.

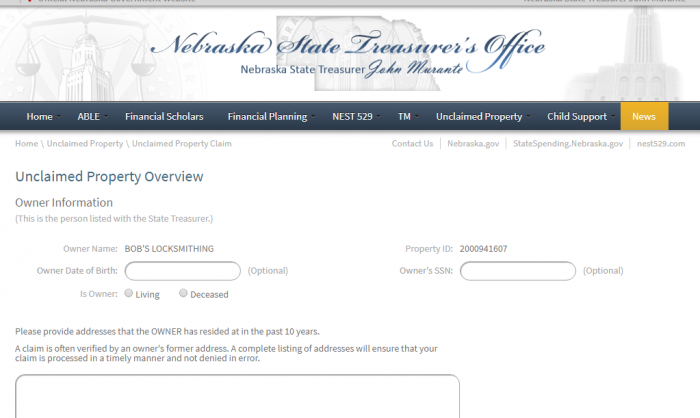

If you hit the “submit claim” form, you get a claim form for that individual claim. In some states, you can choose multiple claims at the same time. However, in Nebraska, you hit “submit claim” and are taken to a claim form for each individual type of property. The claim form looks like this:

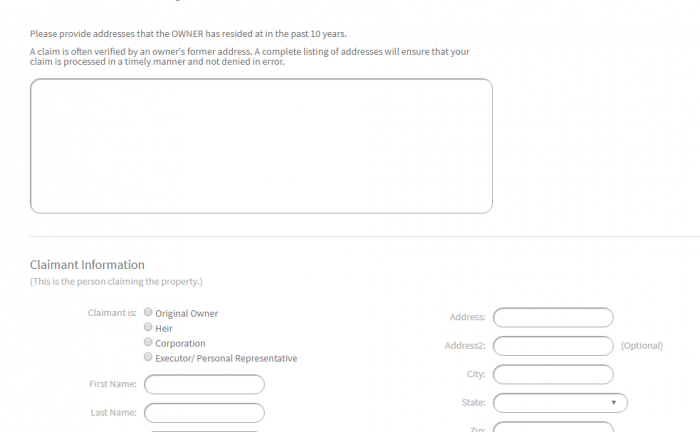

The claim form auto fills in the owner’s name, the property ID, the owner’s date of birth, the owner’s social security number, and whether the owner is living or deceased. You are also asked to provide all of the addresses that the owner has resided at for the past ten years. This is an important thing to know, because you are not required to provide a 10-year address history for most owner’s in most states:

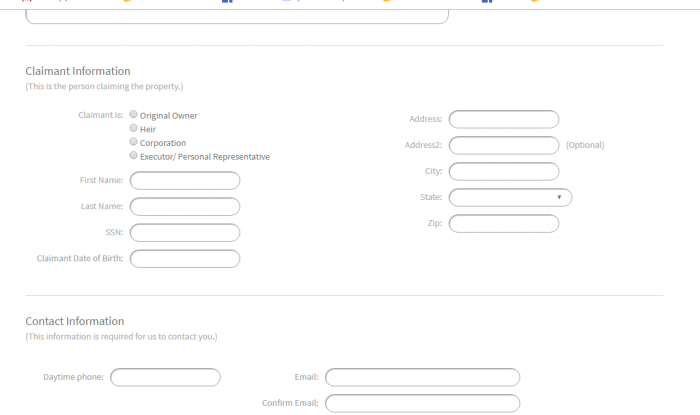

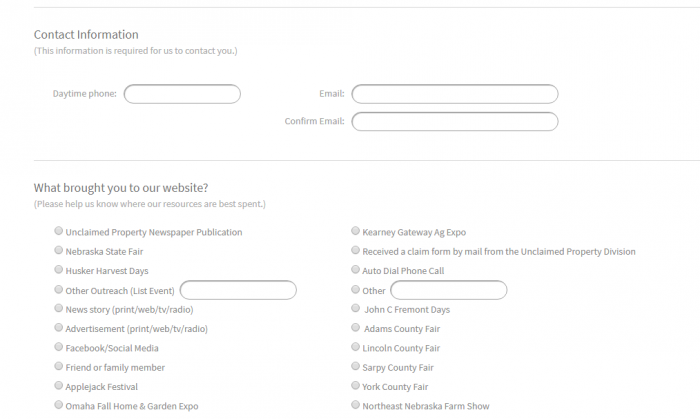

Finally, you will be asked to provide claimant information:

The claimant information will ask if the claimant is: the original owner, an heir, a corporation, or an executor or personal representative. You will also be asked to provide your first name, last name, social security number, date of birth, address, city, state, and zip code. You will also be asked for contact information, like your daytime phone number and email address.

You will also be asked what brought you to the website:

Unclaimed Money Laws in Nebraska

Nebraska’s unclaimed property laws are found in the Nebraska Uniform Disposition of Unclaimed Property Act, Nebraska Revised Statutes §§ 69-1301 et al.

Nebraska Unclaimed Money FAQ

How long does Nebraska hold unclaimed money?

The state of Nebraska holds unclaimed money forever, until it is claimed by the rightful owner or an assignee or heir of the rightful owner.

Examples of Unclaimed Money

While unclaimed money is often referred to as unclaimed property, it actually refers specifically to the types of property that are easily converted to negotiable instruments. Other types of property, like real property and motor vehicles, are specifically exempted from the unclaimed property program. In addition, state taxes are not part of the unclaimed property program. Some examples of the type of property that might be unclaimed property are: the contents of safe deposit boxes, insurance claim payments, dormant savings accounts, security deposits, rebates, gift certificates, bonds, dormant checking accounts, uncashed checks, utility deposits, vendor payments, unpaid wages, and stocks.

Does the state of NE make efforts to locate owners?

Nebraska makes some efforts to locate the original owners of unclaimed property. For example, the State Treasurer goes to county fairs around the state of Nebraska and lets people know about the state’s unclaimed property program. It also publishes a yearly unclaimed property report, which names property by county. The biggest outreach effort is probably the state’s unclaimed property website, which allows you to search the entire state by your name.

Other sources to search besides NE state database?

While your unclaimed property search may start in Nebraska, if you really want to make sure that you are finding and claiming all of your abandoned property, you will probably need to expand your search outside of the state where you reside. For most people, this means expanding your search in two ways: 1) including other states where you have lived or where people who may have left you property lived; and 2) including some national-level databases.

When making your list of states to search you want to include states where you are likely to have abandoned property. That means searching every state where you have ever lived, any states where your ancestors lived, any states where someone lived who may have put property in your name, and any state where you have established business contacts.

In addition to state-level sites, you will also want to include some national level sites. For example, if the federal government has your money, it never turns that money over to the state, so it will not show up on a state unclaimed property database. Later in this article, we will suggest some specific sites to look at if you meet certain conditions, but here are the four national-level sites we think that most people should include in their unclaimed property searches: the Internal Revenue Service (IRS), the Pension Benefit Guaranty Corporation, the U.S. Treasury, and the Life Insurance Policy Locator.

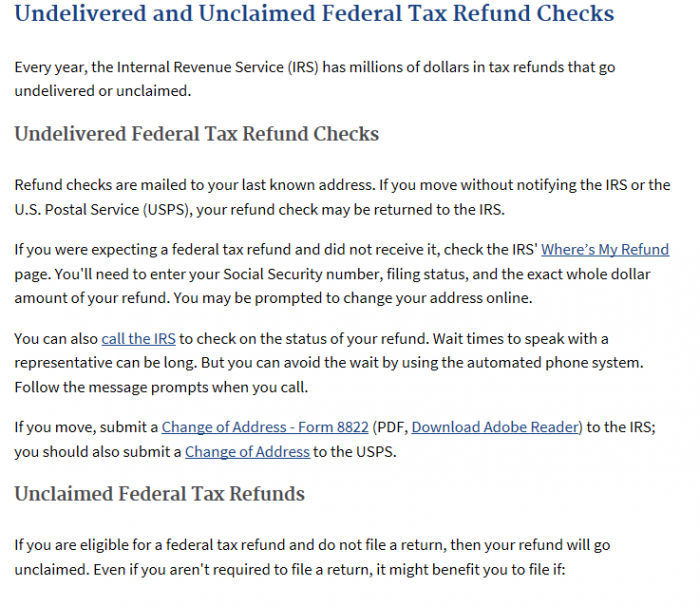

The IRS probably handles money for more Americans than any other holder in the country. That is because it processes income tax. IN addition, it owes money to millions of Americans after taxes each spring. If an income tax refund is not deliverable, the IRS does not forward the check. Instead, it holds onto the refund until the taxpayer can claim it. Moreover, that money never becomes part of a state’s unclaimed property database. The IRS explains this policy on their website:

If you believe that you should have received tax refund money, you should check for your refund on the IRS’s Where’s My Refund? page.

Another federal agency that holds a huge amount of money for regular Americans is the U.S. Treasury. Treasury bonds are an enduring investment opportunity. They are also a very common present for significant events like births, marriages, and graduations, and the recipients, especially if they were young, might not even realize that they received the gift. The U.S. Treasury used to make it very easy to find out if you had an abandoned treasury bond, by providing a searchable abandoned property database on its website. For some reason, it has done away with that service, which makes finding lost property through them much more difficult. However, you can still get them to help you find lost bonds by calling them at 844-284-2676 or visit them at their website for more information: Treasury Direct.

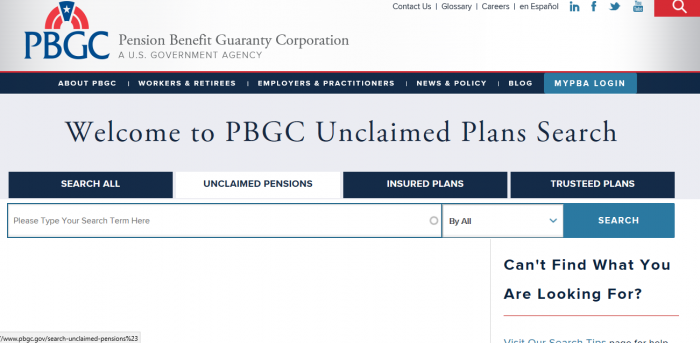

Another must-check source is the Pension Benefit Guaranty Corporation (PBGC). Most people are unaware that there is actually a U.S. government agency dedicated to guaranteeing pension benefits and that this agency operates a database to help people find their unclaimed benefits. Even if you are young enough to be certain that you do not have any surprise pension benefits in your own name, it is worth checking this site to see if you are the heir to any benefits that would have been left in your name:

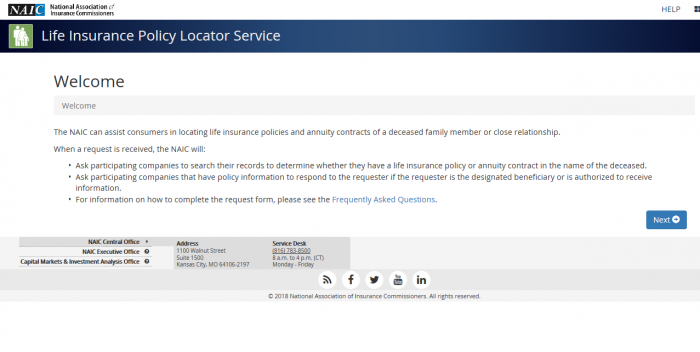

Although not run by the federal government, there is actually another nationwide service that people need to check for their unclaimed property: the National Association of Insurance Commissioners’ Life Insurance Policy Locator Service. A conglomeration of member insurance agencies, this service does not operate a searchable database, but can still help you reunite with your unclaimed property. The process works similarly to a database, in that you enter information to help identify you as a property owner. However, instead of showing you potential claims, the service distributes your information to member insurance agencies, which check to see if you are a beneficiary (or the heir to a beneficiary) on any unpaid life insurance claims:

In addition to the four sites we listed, you may have circumstances that make it likely that other federal/national sites have unclaimed property in your name. Therefore, you may also want to check with these organizations to see if they have any of your unclaimed funds: the FDIC https://closedbanks.fdic.gov/funds/, the Department of Housing and Urban Development, the National Credit Union Administration, and the Veterans Administration Benefits Department.

What is the best way prevent my property from becoming lost or unclaimed?

When people realize how much abandoned property is out there, they start to think about prevention. The best way to keep your property from becoming lost or abandoned is to keep detailed account records so you know where all of your money is and reach out to the holders on a regular basis. You also want to update all of your accounts whenever you have a change in address, phone number, name, or marital status. Electronic account management can make this process much simpler, so choose it as an option when it is available.

How do I make sure my heirs know where my assets are if I die?

Remember that a will is not enough; it tells people how to distribute your assets, but not where to find them. You should designate a trusted individual to get access to your financial records in the event of your death or incapacitation. You can name a lawyer or other professional for this role or to pass on the information, but you want to make sure that one of your loved ones knows how to contact that professional and what type of proof they will need to provide in order to access the information.

Should I hire a finder to conduct the search?

Nebraska does not actually address the use of finder services in its unclaimed property information. However, it is free to run a search and file an unclaimed property claim in Nebraska. Therefore, unless you do not have the time to run a claim yourself, you may not want to pay the fee or percentage associated with using a finder service.

Why does Nebraska take possession of unclaimed property?

As a consumer protection provision that is aimed at helping people reclaim their lost and abandoned property.

Conclusion

While Nebraska does not have a giant amount of unclaimed money, it does estimate that 1 in 5 people in Nebraska have unclaimed money in the state’s database. That is a huge percentage and certainly suggests that everyone in Nebraska should take a few minutes to search for unclaimed property in the state’s database.